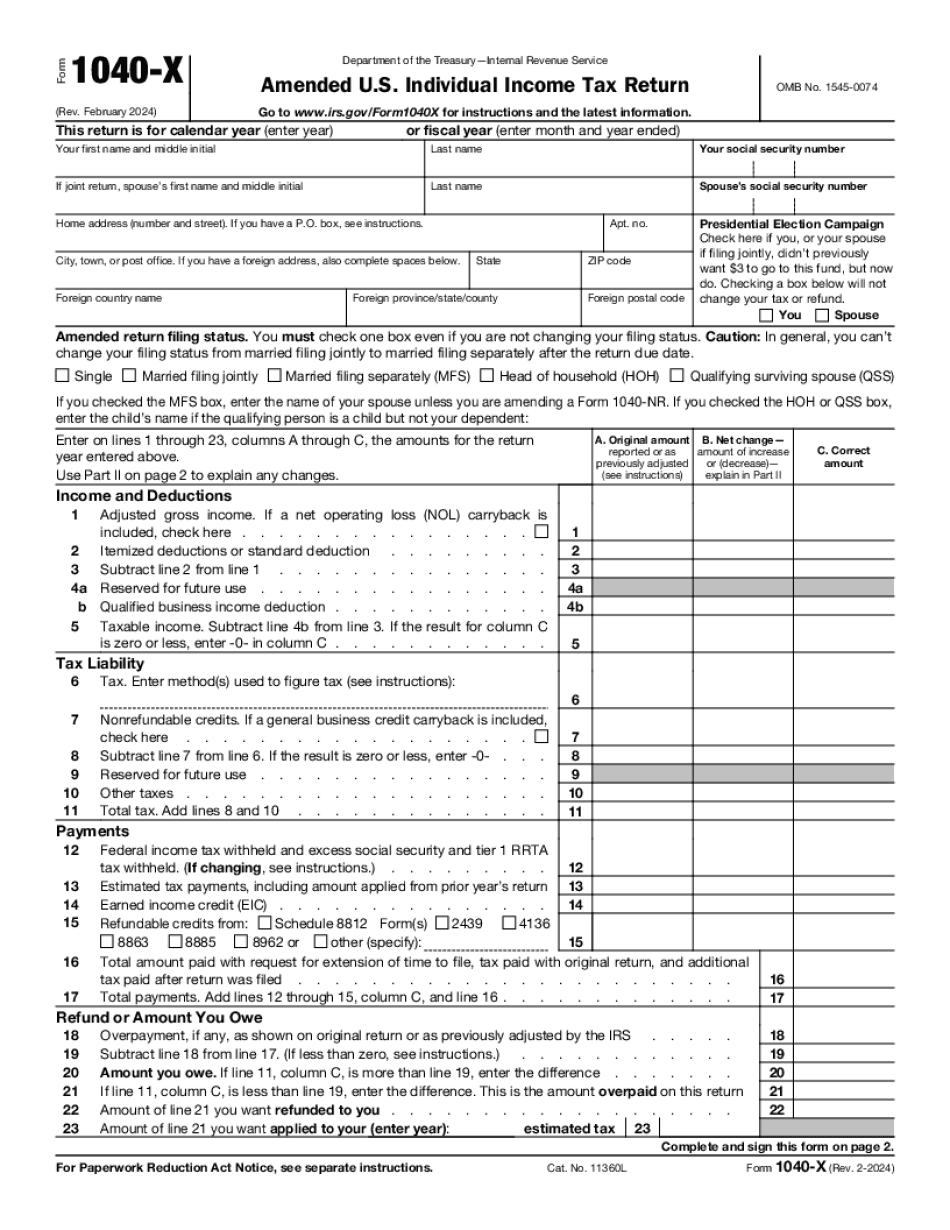

Irs Form 1040x to Amend a Tax Return 2024

Show details

Hide details

Nal return and that I have examined this amended return including accompanying schedules and statements and to the best of my knowledge and belief this amended return is true correct and complete. If you have a foreign address also complete spaces below see instructions. Foreign country name Foreign province/state/county Amended return filing status. Explanation of changes. In the space provided below tell us why you are filing Form 1040X. Attach any supporting documents and new or changed ...

4.5 satisfied · 46 votes

form-1040x.com is not affiliated with IRS

Filling out Form 1040-X online

Upload your PDF form

Fill out the form and add your eSignature

Save, send, or download your PDF

A full guide on how to Form 1040-X

Every citizen must report on their finances in a timely manner during tax season, providing information the IRS requires as accurately as possible. If you need to Form 1040-X, our secure and intuitive service is here at your disposal.

Make the following steps to Form 1040-X quickly and accurately:

- 01Upload our up-to-date template to the online editor - drag and drop it to the upload pane or use other methods available on our website.

- 02Read the IRSs official guidelines (if available) for your form fill-out and precisely provide all information required in their appropriate fields.

- 03Complete your document using the Text option and our editors navigation to be certain youve filled in all the blanks.

- 04Mark the boxes in dropdowns using the Check, Cross, or Circle tools from the toolbar above.

- 05Take advantage of the Highlight option to accentuate specific details and Erase if something is not relevant any longer.

- 06Click the page arrangements button on the left to rotate or delete unnecessary file sheets.

- 07Verify your forms content with the appropriate personal and financial paperwork to make sure youve provided all details correctly.

- 08Click on the Sign tool and generate your legally-binding eSignature by uploading its image, drawing it, or typing your full name, then place the current date in its field, and click Done.

- 09Click Submit to IRS to e-file your report from our editor or choose Mail by USPS to request postal report delivery.

Opt for the simplest way to Form 1040-X and declare your taxes online. Give it a try now!

G2 leader among PDF editors

30M+

PDF forms available in the online library

4M

PDFs edited per month

53%

of documents created from templates

36K

tax forms sent over a single tax season

Read what our users are saying

Learn why millions of people choose our service for editing their personal and business documents.

What Is 1040x?

The taxpayers looking for ways to amend their tax returns for any reasons have to deal with 1040x Form. This document is important for the following:

- 01Correct forms 1040, 1040A, 1040EZ,1040NR, 1040NR EZ.

- 02Change amounts already adjusted by the Internal Revenue Service.

- 03Make a claim for a carryback because of a lost or unused credit.

The most common reason to fill IRS 1040-X blank is to correct mistakes in an original tax return document. To organize the process properly a person may use online templates. They are extremely convenient for quick and correct document preparation. Online samples enable you to sign them electronically, that completely eliminates paperwork hassles. After signing, you may share the file via email, fax or sms.

The 1040x Form is self-explanatory thanks to the detailed description of all necessary steps so that the taxpayer can record all details properly without any complication.

- 01The header of the first page here is similar to the 1040 Form. Indicate the tax year you want to amend. In case, you need to make changes for more than one year, create a separate document for each one.

- 02Pryour name and social security number, address and contact numbers.

- 03Read attentively the left-most column that contains detailed descriptions and instructions.

- 04All figures have to be provided in the right three columns.

You can file the 1040-X Form within three years from the date you submitted your original return.

Questions & answers

Below is a list of the most common customer questions.

If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is the purpose of Form 1040-X?

For example, you take out a distribution from your retirement plan for your beneficiary (your spouse or your child with a disability, for example). Then, after you have used up all the benefits in the plan, you will have a distribution that is subject to the rules discussed below.

Do I have to include a Form 1040-X with my return? (Updated 2/5/16)

This is a complicated question, and the short answer is yes. All the other returns have to be filed separately if these distributions occur.

However, the rules can be complicated. It is important to understand the rules for the 1040-X and the distributions it will be used to report on your Form 1040. For this purpose, we will discuss the important sections of Form 1040X as well as the other schedules (see later) that you have to file on the same day you file Form 1040.

Form 1040-X (Disclosure of Gain on Sale of Property of Individual)

Form 1040-X is the only form you have to file with your federal income tax return for a distribution from a qualified retirement plan. Form 1040-X requires a qualified distribution to be a distribution from a qualified retirement plan that meets all the following criteria:

Your distribution must be from a qualified retirement plan for any individual underage 59½ at the time of distribution.

You must use some distributions of the qualified plan, such as in the case of a joint distribution with a qualifying participant.

Your distribution must be from an amount that is more than a qualified distribution within the meaning of section 402(c)(3) of the Internal Revenue Code. In other words, the distribution must be more than a qualified distribution if any of the following circumstances apply:

It is made from the portion of the qualified plan that is required to be used to obtain qualified benefits. You must use some or all of your distributions from such funds to obtain qualified benefits.

The qualified plan would be subject to subsection (h) of section 704 of the Internal Revenue Code if the qualified plan were a private retirement plan.

Who should complete Form 1040-X?

The person most likely to file Form 1040-X for a year-end return:

• If a filer will file a joint return or

• If a filer will file an independent return, with no dependents.

Other than for tax year 2014, and in the case of individuals who filed separate returns, all filers are expected to file a Form 1040 for their full 2016 tax year.

Do I need to complete all the “items” from Form 1040-X in order to make sure I file a complete tax return?

You need to complete only the items in the order listed on the original Form 1040-X, and you don't have to include any items that you do not want to complete. This includes items such as a Form 946, a return or payment agreement; Form 941-F, a report of foreign bank and financial account activities; Form 1041, a statement of estimated tax; and Forms W-2, W-2G, Form 1099, and Form 5498. If one of these items is used, all the items must be completed and filed in order to be complete.

For Tax Year 2016

How do I fill out Form 1040-X?

There are three ways to fill out and file Form 1040-X:

1. Download the Form 1040-X (2016) application.

• Download by clicking on the link below, or

• Print out the form and print it out on 8½-by-11-inch paper or on a letter sized card.

Download Form 1040-X (2016) Application (PDF)

2. Complete and attach the instructions.

• Fill out the instructions under the Form 1040-X (2016) application at

3. Complete a separate Form 1040-X (2016) application.

If an individual who doesn't file a separate Form 1040-X (2016) application for a previous year, but who will file an official return with the IRS for 2016, he or she must complete and file a Form 1040-X (2016) application in addition to the Form 1040 (2015) or Form 1040X (2014) if applicable.

Download a separate Form 1040-X (2016).

When do I need to complete Form 1040-X?

Generally, taxpayers should complete Form 1040-X by the last day of the period they expect to be able to claim the foreign earned income exclusion or foreign housing exclusion. However, taxpayers could be eligible to claim deductions for foreign earned income tax paid on the following dates:

January 31 (January 31st if filing an extension) March 15 (March 15th if filing an extension) November 11 (November 11th if filing an extension)

This information is only meant as general guidance as to when to complete your tax return.

How do I apply for a Social Security number (SSN)?

SSN application forms are available from your local Social Security office or from the FAFSA website at FAFSA.gov. You may also apply in person at a Social Security office or on the Internet directly at Social Security's website.

Is my foreign earned income tax paid amount taken into account on my foreign income tax return?

Foreign earned income tax paid is income (such as wages, wages and salaries, interest and dividends, annuities, retirement plans or pension benefits) that is not subject to U.S. tax. As a result, the U.S. does not include foreign earned income tax paid amounts on Form 1040A or on Form 1040EZ. Instead, this amount is reported on Form 8938. Thus, if you are claiming the foreign earned income exclusion on a foreign tax return, you had better file Form 8938 rather than Form 1040A.

I am a nonresident alien. How do I claim a refund?

You may be eligible for a refund of any amounts that were not properly shown on your most recently filed federal income tax return, if the tax period that includes the return period of your tax return did not meet the requirements for a refund. You must complete and mail Form 2106 to the IRS.

How do the IRS send its monthly statements?

The IRS sends its monthly statements to you, and they are mailed by first class mail. To have the statements mailed to you by first class mail, you must follow the instructions on the tax return. This applies to all monthly statements that you receive after the 25th of the month of the taxable year after the calendar year in which you received these statements.

Can I create my own Form 1040-X?

You must prepare your own Form 1040-X and fill it out on Form 1040 or Form 1040A. You can use the instructions listed on your form to prepare your own return. If you're a nonresident alien spouse or common-law partner, your spouse or common-law partner must file your Form 1040-X with the tax returns you file for this income tax year.

Form 1040-X is the only way to get a form that's used in all 50 states.

See a list of your state-specific instructions for form 1040-X instructions.

If you have a spouse or common-law partner outside the United States and all of their tax returns are filed with you, see a list of your partner's state-specific instructions for form 1040-X instructions.

Can I submit my Form 1040-X electronically?

If the IRS does not accept electronic payments, you may file Form 1040-X by providing it by paper. See the instructions under the Related Information in the Additional Information section of the Instructions.

Can I submit my Form 1040-X in any particular manner?

Can I submit other return information by email, fax, mail, or online?

In some situations, you may have more than one method available to submit your form. You can learn if additional methods may be available by consulting with our payment service agents. If you choose to submit your Form 1040-X using a third-party payment provider such as PayPal, MasterCard, or American Express, the provider will process your Form 1040-X for you.

You can learn the latest payment options available to you in Payments and Offers.

Do I have to send a copy of my Form 1040-X to the IRS?

In some circumstances, you will be charged a 10% late fee or a penalty on your tax return in some circumstances. You may qualify for a waiver of interest if you submitted your tax return electronically in 2016. To qualify for this waiver, you must provide an affidavit attesting to your eligibility and your inability to submit your tax return by electronic media, such as a fax, email, or paper copy. Contact the IRS website for more details.

What should I do with Form 1040-X when it’s complete?

When a new Form 1040-X is filed for the return of a qualified electing large employer (FLESH), you must follow these procedures. Use the instructions for Form 1040-X to process the Form 1040 at the correct address and with the information and procedures that are applicable for the particular event. Send your completed Form 1040-X by certified mail with a return receipt to the U.S. address on Form 1040-X. Include the return receipt with your completed Form 1040-X in case the Form 1040‑X is returned to you because you do not send it through the proper mail. The return receipt shows the date it was received.

How do I submit my Form 1040‑X with the U.S. Department of the Treasury (Treasury) on Form 1040-S?

The return should be filed with Form 1040‑S or Form 1040‑X. Use the instructions for Form 1040‑S or Form 1040‑X to process the Form 1040 and send it through the proper mail.

If I sell my business and dispose of my remaining assets, should I complete Form 1040‑S?

You should complete Form 1040‑S to claim a personal exemption if you sell an interest in your employer's business.

For more information, refer to chapter 18.

How do I obtain information about how to file Form 990-N?

You may obtain information about how to file Form 990-N by contacting your local U.S. Post Office. If you do not have one, the IRS can send copies of the Instructions for Forms 990-N to any U.S. address by regular mail or use their Website and look for the Form 990-N, 990-N-EZ, or 990-N-SH pages for your state, and then follow the directions there. Visit IRS.gov/Forms for more information about filing your tax return for the year ended December 31.

If you have no local U.S. Post Office available, you should use your most recent federal tax return, pay stubs, or electronic tax return software to obtain your Form 990-N. However, we cannot accept paper-return receipts that are not completed and properly completed by your preparer.

For additional instructions, visit IRS.

How do I get my Form 1040-X?

Fill and Sign your form and mail back to us.

You will receive confirmation email within 24-48 hours; however, if we receive no confirmation by 2 p.m. that day, the file will be marked as received, and we will not send it to the USPS. Please note that it takes approx. 3-4 weeks for us to ship the form to you, and we do not have the ability to process late forms.

Forms in PDF format are available upon request by e-mail. Please request our e-mail here.

For more questions please click here or email me at gtobrienhuffpost.com

How Do I Get My Form 1040-M?

Fill and Sign your form and mail back to us.

Please note that there is an additional processing fee of 25 for electronic submissions when filling out your online form. Please refer to the Fees section under the link below.

Click here to see all form fees.

For more questions please click here or email me at gtobrienhuffpost.com

I received my application fee, what do I need to send back?

Fill and Sign your form and mail back to us.

Please note that you will need to include a check or money order made out to HUMAN with your payment.

For more questions please click here or email me at gtobrienhuffpost.com

If I fill out my Form 1040-M and receive an approval letter, how do I get my Form 1040-X?

Fill and Sign your application and mail it back to us. We receive many applications from all over the country, so it often takes several weeks for us to process your application. If you receive an approval letter, and you have not heard from us within a few weeks (if at all) please contact us, so we can work out a date to go through the process with you.

What documents do I need to attach to my Form 1040-X?

When filing your federal income tax return, you must attach a completed Schedule A to your federal income tax return. You may also attach Schedule C (Form 1040) (or part of Schedule C) if you file Form 1040X and did not pay estimated taxes using Form 8889. For more information on submitting your Form 1040-X as information for the Filing and Paying Agent, see Topic No. 404.

Note. If there is a conflict between a return and the form attached to it, the return is taken into account.

Do I have file time to prepare Schedule A? If not filing electronically, do I have to prepare or file a Schedule A? You have 10 hours of file time and have to prepare or file a Schedule A.

Do I have to attach my Form 1040X to Schedule A if I am filing electronically? Yes. You must attach and file the Schedule A if you filed an electronic tax return. You have 10 hours of file time and have to prepare or file a Schedule A as described in question 2.

Do I have to file Schedule A even if I paid estimated taxes using Form 8889 and am due estimated taxes? Yes. If you paid estimated taxes using Form 8889 and owe estimated taxes, attach a statement and report an overpayment of estimated taxes to complete Form 1040X. For more information, see the instructions for your Form 1040-X.

Do I need a certified copy of my Form 1040X? No. You can use your version of the Form 1040 as a substitute for a printed version of your tax return. You may have additional information, statements, and other documents that you need to file with your copy of the paper form.

Can I use a paper Form 1040 for an annual return if all of my tax information is electronically filed? Yes. See Question 12.

What is the difference between Form 1023 and Form 1023-A? Form 1023-A is a Form 1023 that was filed electronically. Form 1023-A has not been processed in paper form.

Can I use Form 1040X for a state income tax return? If you filed a state income tax return using Form 1040X, you could use Form 1040X or form 1040NR to report the state income tax due. However, you may not report the same amount on different pages.

What are the different types of Form 1040-X?

Individuals, businesses, trusts, estates, trustees, and certain other taxpayer categories are entitled to Schedule A (Form 1040-X) instead of a standard 1040-ES return.

Form 1040-X

As the name implies, Form 1040-X is the form you make when you are filing your federal tax return. It is prepared by an IRS Form 1040-XA, or you complete an IRS Form 1040-X using the tax software available through your IRS service. The Form 1040-X also is the form that you use when you file a return if your total income is 60,000 or less.

In order to be considered exempt, your gross income cannot exceed 60,000 for the year, and you may have to file an additional self-employment tax return if you have more than one employer. In some cases, the total income must be reported on your gross income tax return if you are required to file an amended tax return.

There are various income and deductions that you take on Form 1040-X. You will see various examples and instructions if you are preparing the form yourself.

Schedule A

The following information is also available on the IRS Website. It describes the types of payments you must make to the IRS.

Individuals

Schedule A (Form 1040-XA) is a paper form that you used to make your federal income tax refund and the income tax payments you make to the IRS. If you have trouble making your tax payments with the paper tax form, contact your IRS service.

Businesses

Schedule A (Form 1040-XA) is a paper form that you used to make your federal income tax refund or the tax payments you make to the IRS. If you have trouble making your tax payments with the paper tax form, contact your IRS service.

Trusts

Schedule A (Form 1040-XA) is a paper form that you used to make your federal income tax payment and the income tax payments you make to the IRS. If you have trouble making your tax payments with the paper tax form, contact your IRS service.

Payments made with Form 1040-XA

Your total income that is greater than 60,000 for the year does not require an additional self-employment tax return if you have more than one business and one taxpayer does not have employee deductions and tax withholding.

How many people fill out Form 1040-X each year?

We do not keep track of individual numbers.

If my total tax liability is zero, is the amount I report on Form 1040-X taxable?

No. The amount of income tax you owe is computed on Form 1040-X, so if you deduct any income tax you owe, you will not be able to claim a deduction for the interest on your federal tax refund or for any tax, penalty, and interest on your state income tax refund but may claim a credit for tuition or other fees paid to a non-profit educational institution. The credit is usually for the full amount of the tuition or fees paid, even if you use only part of that amount to repay federal tax. If you have any tax withheld (or withheld and remitted) because the education is considered a tuition waiver then that amount is not taxable.

If I earn less than the amount shown in box 2 on my Form 1040-X, is that credit taxable?

Tax credits are not taxable.

If I earn more than the amount shown in box 2 on my Form 1040-X, is the amount taxable?

Generally, this amount is not taxable. Some education tax credit information is in the publication Guide to the Education Tax Credit, Publication 15, pages 5 and 9. For a full description of the education tax credit, see the publication Educational Tax Credits, Publication 529, page 10.

If I earned less than the amount shown in box 2 on my Form 1040-X and my refund was limited to qualified tuition and related expenses, do I have to include the tax I owe on Form 1040-X as income?

For 2017, education tax credit amounts are reduced by 300 for the portion of a refund that exceeds 5,000, and the portion of any refund that exceeds 1,200. This amount is added to your income and is included in gross income on Form 1040. This is true for 2017 but not for 2. See Repaying Education Tax Credits, later, under Repayment and Deduction.

If I earned less than the amount shown in box 2 on my Form 8938 and my refund was limited by IRS limitations, do I have to include the tax I owe on Form 1040-X as income?

No. This amount is not taxable if you filed Form 8938 within 1 year prior to August 15, 2015.

Is there a due date for Form 1040-X?

All income tax returns are due once a year, usually on the 15th day of February. Income tax withholding and payment deadlines for the 2018 tax year are set for January 31, 2019.

When will I receive a refund if I filed a tax return during 2017?

There is no refund due for tax year 2017 that is due to you unless you file an amended return or file a joint return or a joint return and you and your spouse each file a 1040-ES, 1040-T, 1040-X, 1140-X, or 1141-X separately. If you filed a joint return, income tax withholding is expected due in late February unless you timely claim an exemption. If you and your spouse each get a Form 1065, you may receive the refund earlier if you file Form 1040-ES by April 15.

What should I do if I receive a “Forfeited Funds” statement?

Forfeited funds statements can come up when you are closing out an IRA or FSA and have left a balance remaining. You may have to pay the difference between your account balance at the time when you closed the account and when your IRA or FSA was closed, plus any late fees paid during this time period.

If you have a balance on your IRA or FSA that is equal to the interest on an account with a 5-year or less maturity, and you close the account and leave a balance there, any money in there is considered to be a forfeited fund. If you are required to pay taxes on any income from a forfeit fund, you should take care to keep any money in that forfeited fund from tax time forward to avoid a penalty and interest, particularly if the forfeited funds are tax-exempt.

For more detailed information, see IRS Publication 502, Tax Withholding and Estimated Tax.

Why is my Form 1096 filed late?

A Form 1096 is a report your employer uses to report to the IRS the compensation paid by employees. If you are required to file a federal income tax return, make sure your income tax return is filed on time and complete it accurately.

How long after a Form 1096 is filed will I get a refund?

Your refund is expected to be due approximately four months after your return is filed.

Popular Forms

If you believe that this page should be taken down, please follow our DMCA take down process here