Music, music. Join the millions of Americans who safely filed their taxes and save money using IRS free file. Taxpayers can use either name-brand software or fillable forms for free. Combining IRS free file with direct deposit is the quickest and safest way to get a refund. Here are some tips about IRS free file: 1. Get started at IRS.gov. IRS free file is available only through IRS.gov. Simply choose a free file company and then click on the link to prepare and e-file the return. 2. Find tax breaks. The tax software's question and answer format helps eligible taxpayers find tax breaks. This could include tax credits such as the Earned Income Tax Credit. The software then selects the appropriate tax forms and does the calculations automatically. 3. Free for all taxpayers with income of $64,000 or less can used brand-name software. Taxpayers who earn more can use free file fillable forms. This option allows taxpayers to complete high IRS forms electronically. It is best for those who are used to doing their own taxes. 4. Easy online extensions. For those who cannot finish their return by the April 18th deadline, it's easy to use refile to request a six-month extension. An extension of time to file is not an extension of time to pay. If taxpayers overal taxes, they should pay the amount they owe and pay it with the extension request. This will help avoid penalties and interest. 5. The IRS partners with leading tax software companies, the Free File Alliance, to make the program available. Some companies offer free state tax return filing as well. 6. All taxpayers should keep a copy of their tax return. Beginning in 2017, taxpayers using a software product for the first time may need their adjusted gross income (AGI) from their prior year tax return to...

Award-winning PDF software

Free file fillable s 2025 Form: What You Should Know

Virginia State Library, at no cost Free File | Virginia Library If your 2025 income was at least 73,000, you may be eligible to file through this provider. As the name suggests, this Virginia Library provides free information and services to Virginia taxpayers. The Virginia Library also offers a free Virginia Taxpayer Assistance Program (TAP). TAP helps you determine if you are eligible for a tax credit or tax Free File Fillable Forms Get an overview of free file fillable forms for the next year's taxes, using our comparison tool. A quick note about personal Free File|Virginia Library If your 2025 income was 73,000 or less you will be able to obtain a free tax fillable form (fillable for electronic filing) from the Virginia Free File Fillable Forms Free File Fillable Forms, Form 8821 (PDF) Free File Form 8821 (Electronic Filing) is now available. Get information about how, where, and how much you may be Free File Fillable Forms Virginia State Library | No Taxpayer Fee Free File Fillable Forms with paper-free filing for taxpayers whose income is Under 73,000 and under the AGI of 150,000. Free for the next tax year Free File Fillable Forms Virginia State Library, No Taxpayer Fee Get information about where and how you may be eligible for a tax credit. This provider will provide you a Get a list of Virginia options in 2018. Get Free Tax Transcript for 2025 (PDF) Vintage Tax Service | 2 Season A free, automated tax transcript service that matches eligible Virginia taxpayers to the most efficient vendor service Virginia Tax | Tax Season 2018 Tax season 2025 opens Sept. 5, 2018. Taxpayers may find the following free tax Vintage Tax Service 2 (PDF) Virginia State Library, Non-Filing and Filing Season 2018 Vintage Tax Service | Tax Season 2 Free File Fillable Forms is available at no cost. Tax filers can file their 2025 tax returns Get help to prepare and filing your 2025 taxes for free Vintage Tax Service | 2 Season Tax season 2025 opens in late January.

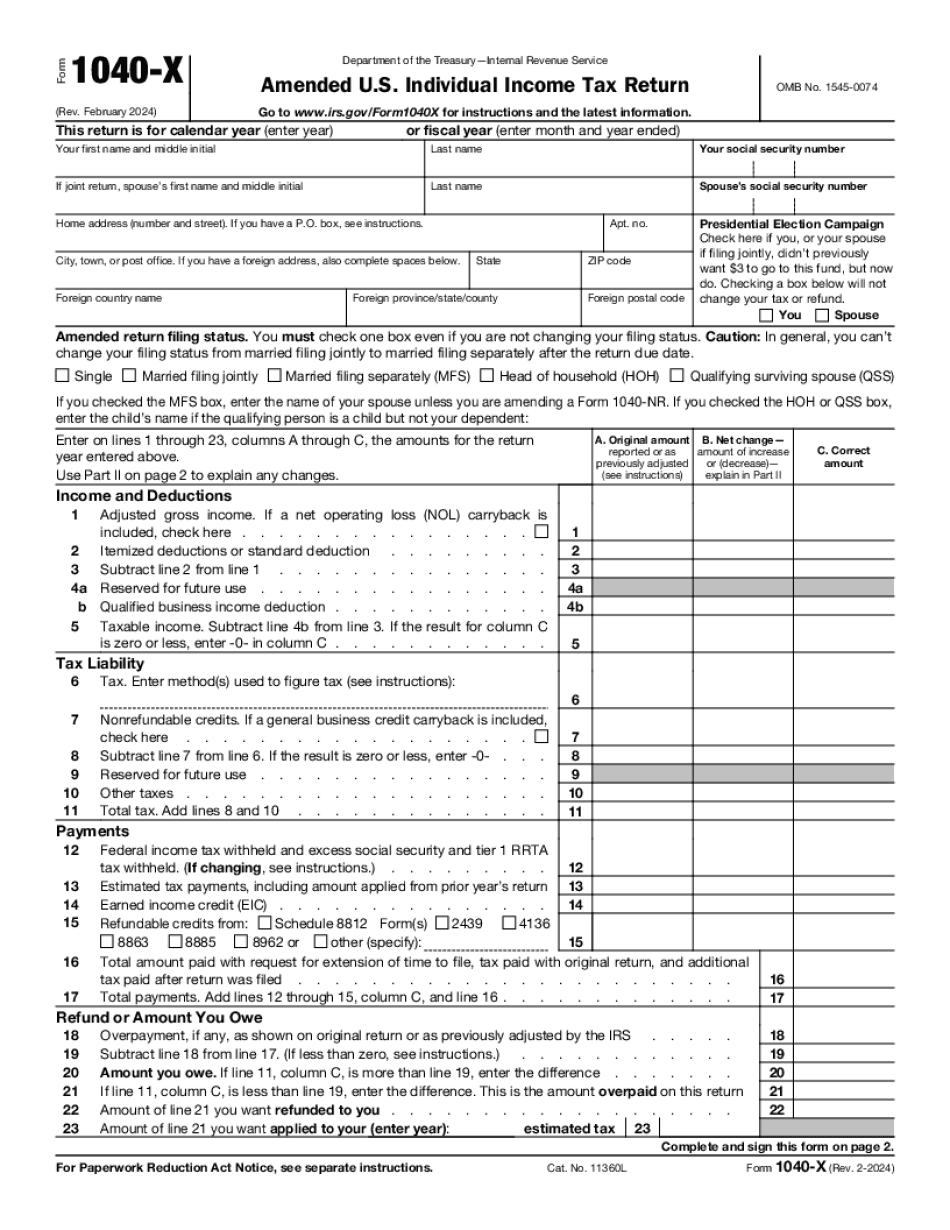

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 1040-X, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 1040-X online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 1040-X by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 1040-X from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Free file fillable forms 2025