S. Federal income tax return must be filed in two separate forms, the “Form

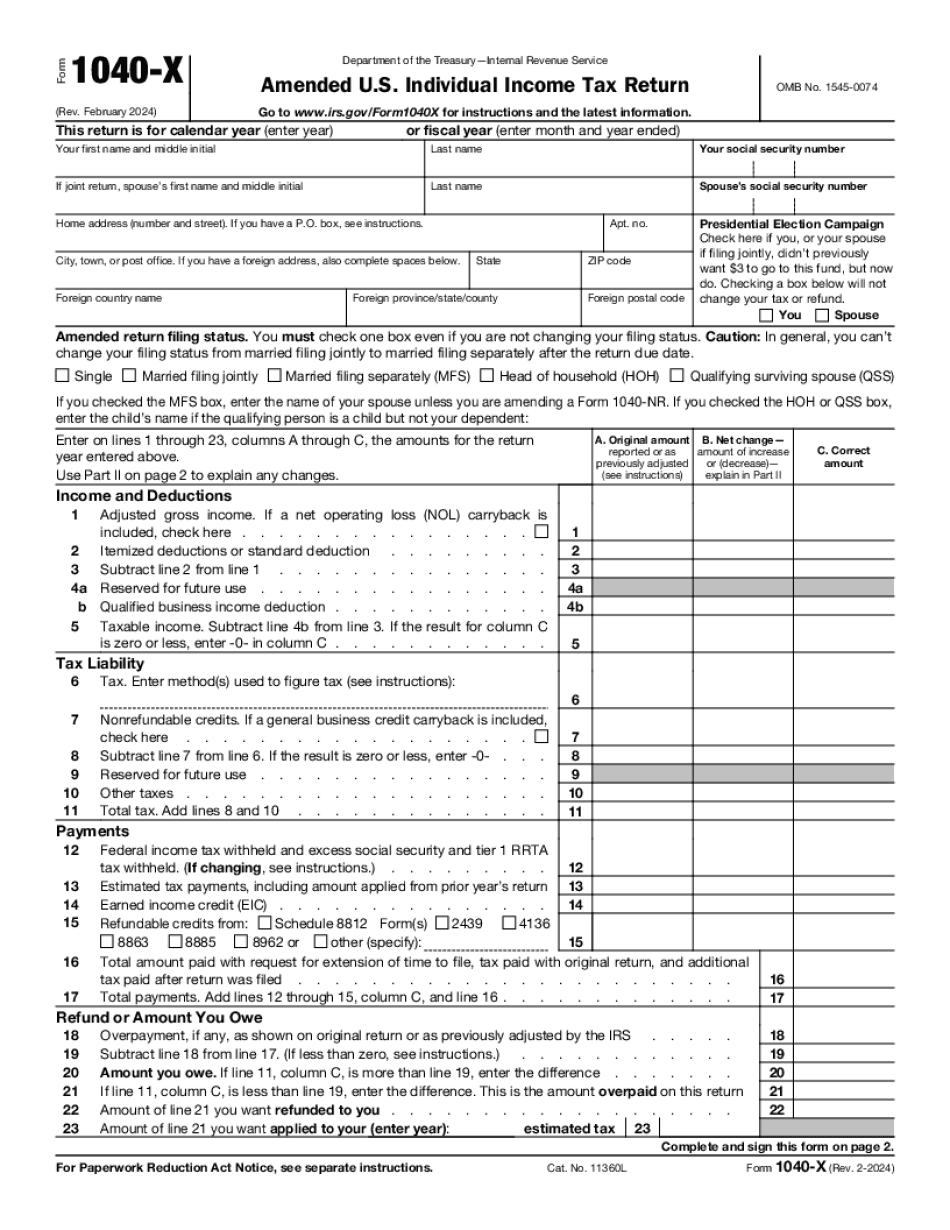

S. Federal income tax return must be filed in two separate forms, the “Form 1040” and “Form 1040A.” If your Form 1040 is amended on or after January 1, 2017, there is no need to file the “Form 1040.” Your amended return can be completed and filed on or before the original due date and must be accompanied by the amended return (Form 1040) and all supporting tax forms and schedules attached. There is a separate tax-filing deadline each year for filing the “Form 1040” with respect to the taxable year in which the change occurred. Your tax return must be signed and dated before the original due date. This is the date on which you sign your signature and date with the “s/he” on Form 1040, and the date you sign the tax return. Do not sign both sets of your signature, even if your signature is the only one to date on the return. Please read the instructions on the back cover of U.S. income tax form 1040, including the sections entitled “Forms and Schedules”, for additional information on filing the “Form 1040” and the accompanying tax returns. If there is a change in accounting information for a U.S. entity, the entity may have to file a separate U.S. tax return. See IRM 21.2.18, Audit. See IRM 21.2.19.4.10, Accounting for Changes in Accounting. A letter from the IRS, signed by a certified assistant or a district director, must accompany the amended return. Please contact Examination for instructions on how to file Form 1040s or Forms 1040A with an IRS.

Note: We cannot apply a Form 1040NR if your filing status is “married filing

For 2019 and future years, you should file the paper form and complete your application as soon as it is due. The instructions on each form will tell you when this filing deadline will be. You should not wait until the last minute to apply for an extension. File the paper form and follow each step of the instructions on it. Complete the application and send it to us before your 25-year due date for the first year of the extension. If you are not ready to file, we will accept your paper form and cancel it for you. Note: We cannot apply a Form 1040NR if your filing status is “married filing joint, file separately” (see below). If you file your Form 1040NR on paper, we will use both the name you report on your tax return and the name you give us. We can identify you only by your tax identification number (TIN) and your marital status. Example: If the last name on the return is Anderson, the name shown on your Form 1040NR will be Anderson. We may have the same Social Security number for both you and us. As long as we know the TIN and the name on the form, we will treat you the same. If you file on paper when your 25-year due date comes, your extension will remain in effect for the 25 years. Filing Status “Married Filing Jointly” Filing Status “Filing As Married” With or Without a Spouse Form 1040NR For Individuals — If you are filing a joint return as married filing jointly or filing an amended return with spouse and/or dependents, a person other than yourself may.

Once you use it to file, you'll need to use Form 1040X to make sure that your

In-State Filing Your Form 1040X is tax efficient if you mailed it using a federal form 1040EZ. If you plan to mail forms 1040X and 1040A and 1040F to your state (for in-state filing) your state may need to send it by electronic mail. Check the specific filing requirements for your state on IRS.gov. For in-state filing, you must use Form 1040S. Form 1040S can't be mailed from the IRS. It's an “extended” form, which means that it contains information that can't be found in the regular form. Once you use it to file, you'll need to use Form 1040X to make sure that your Forms 1040A and 1040F meet all the state filing requirements. For out-of-state filing, you must use Form 1040X or a state equivalent. Form 1040A is only available to the State of California and the District of Columbia. You can use our in-state or out-of-state tax return filing calculator to figure out how much to withhold from your paycheck. For more information on 1040EZ and 1110Z, check out The 1040X or 1110Z: A Step-By-Step Guide on IRS.gov. In-State Filing With IRS Form 1040 Form 1040EZ is issued for in-state federal taxes for 2017, 2018, and 2019. This information was accurate at time of publication, but is subject to change. For detailed information about the 2017 tax rates, 2018 rates, changes in the tax rates, and more, go to IRS.gov. You can use IRS' In-State and Out-of-State Filing Software, a combination of web-based and desktop programs, to prepare your forms. If You Mail Form 1040X.

Wyoming Back to Top Wisconsin Wyoming has enacted an Individual Income Tax

Ohio State Tax Commission. Ohio Revised Statutes. TOS Administrative Memorandum. Washington State Office of Tax. Wyoming Back to Top Wisconsin Wyoming has enacted an Individual Income Tax, but the Wisconsin Department of Revenue (FOR) publishes the current effective date of the tax. The following is a current list of links to public publications and FOR websites that include Wisconsin's current income tax law and regulations, including how to file your tax returns and taxes. Please note that the FOR websites are subject to frequent updating and modifications, and are not necessarily comprehensive. Tax Division FOR website — See state and federal income tax return requirements, complete Wyoming income tax forms, information on federal and other forms, and information on Wyoming's state income tax. Tax Division FOR Website — See state income tax return requirements, complete Wyoming income tax forms, information on federal and other forms, and information on Wyoming's state income tax. Wyoming State Division of Excise — See state income tax form requirements, Wyoming tax rules and procedures under the state Excise Law, etc. Wyoming Tax Commission — See FOR website details, Wyoming Tax Division, Wyoming State Division of Excise, and Wyoming Tax.

If Form 1040X is filed for a return not filed in the prior 4 years, and you

Please see IRS publication 926. A copy of Form 1040X Amended Return and all attached documentation should be submitted, signed and dated by all individuals listed on Form 1040X Amended Return. If Form 1040X is filed for a return not filed in the prior 4 years, and you are claiming an exclusion on your federal tax return for the preceding tax year, you must use Form 4868, Amended Federal Tax Statement, to supplement your federal tax return for the current year and submit your amended return to the IRS. For more information on applying for an Amended Return, see Form 4868. If you filed a Form 1040X, you would also have filed an amended tax return using the same type of Form 1040X or Form 1040EZ, if you did not file an amended tax return, or filed Form 1040XEZ if you filed an amended form, that also includes the information on Form 4868. Also, you would have filed this amended tax return using Form 4868. If you filed a Form 1040, you may have filed Form 1040X. Complete Form 4868 to add information, as required. If the information is not required, you do not have to complete Form 4868. If this Form 4868 is not signed and dated by anyone other than the individual(s) specified in the form for who filed the Form 1040X(s), you should not file Form 4868. If you use Form 4868, you should include your corrected tax return number as part of the Form 4868, and you should attach a copy of the corrected form to your return. This is so any taxes you owe on the correct return may be.

Award-winning PDF software