Award-winning PDF software

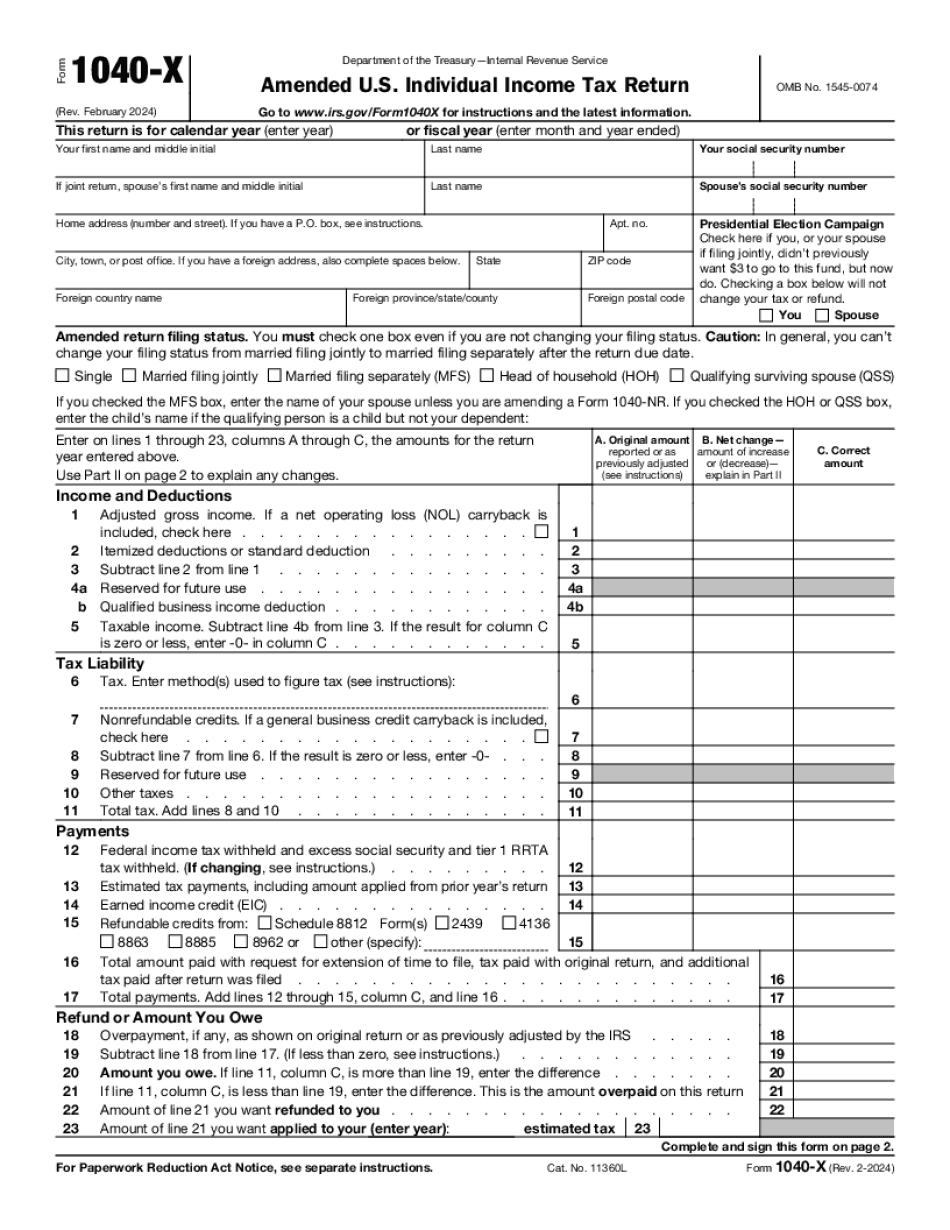

About form 1040-x, amended us individual income tax return

Question quiz File electronically through the Internet IRS Form 1041-X electronic filing Tips for using Form 1041-X 200-question quiz IRS Form 8800-Q (e-File) electronic filing Printable instructions and form Download the form via e-file Citizens Advice Bureau The CAB can help you with a range of tax-related issues and questions, including tax forms and documents, debt, mortgage, finance, tax adviser contacts and more. Do you know the law regarding tax preparers? Tax preparers who prepare tax returns for clients who are subject to HM Revenue and Customs (HMRC) tax law are subject to the general law of self-assessment on the basis of that preparation. This means they are required to ensure that they keep a tax record for every client and to complete and sign any documents required by HMRC. In addition, they must notify the client in writing of any change or the need for updates to a record.

form 1040-x (rev. july ) - internal revenue service

See Instructions for Forms 1040-X. (Sept. 2013) Form 1040-K. (Jan. 2009) Form 1040A. (July 2011) Form 1040K. (Jan. 2009) Form 1040-Q. (July 2011) Form 1040. (July 2011) Form 1041. (Apr. 2012) Form 1040NR. (Mar. 2009) Form 1041NR. (Apr. 2012) Form 1040NR. (Apr. 2012) Form 1042. (Sept. 2017) Form 1040NR-EZ. (Apr. 2012) Forms W-2 and W-2EZ. (Apr. 2012) Amended Individual Form W-2. (March 2009) Form W-2, W-2C, and W-2G. (Oct. 2016) Form W-3EZ and Forms W-3G. (Dec. 2016) Form 8889. (Nov. 2012) Form 8889A. (Nov. 2012) Form 8889. (Nov. 2012) Form 8889. (Nov. 2012) Form 8889A. (Nov. 2012) Amended Individual Form 8889. (Nov. 2012) Form 941. (May 1995) Form 941. (May 1995) Form 920. (Sept. 2018) Form 920A. (Sept. 2018) Form 3903. (Nov. 2013) Form 3903A. (Nov. 2013) Form 3903. (Nov. 2013) Form 3903A. (Nov. 2013) S-Corporation Return. (Sept. 2018) Form 1120. (Sept. 2018) Form 1043. (Nov. 2013) Form 1045. (Nov. 2013) Form 1040EZ (EZ Only) and Form 1040NR (NR Only). (Oct. 2016) Amended Individual Return. (Nov. 2013) Form 1040. (Nov..

What is the 1040-x form?

When you use Form 1040-X to request a federal estate tax return, you must indicate, by checking one of the boxes below, that you request information about the surviving spouse or decedent of a deceased dependent. The information on Form 1040-X that you send with a request for a federal estate tax file is called a copy. You can check the checkbox, check the box to indicate that you are requesting an electronic copy, or check an appropriate box to indicate that you do not have an electronic version of Form 1040-X. (E) A request for an electronic copy of Form 1040-X must be sent to the address on file with the service, or you can obtain a copy by visiting Form 1040-X will be electronically filed (returned through the mail). Do not send Form 1040-X by fax. (F) If you request an electronic copy of Form 1040-X by fax, do.

Amended tax returns and form 1040x - h&r block

You can't e-file. If you choose to e-file, you must print one copy of each form and complete it using only the information provided on the form. If it applies to more than one person, the one with the most recently filed federal tax returns must complete it. E-files must also be received by the IRS no later than 3:59 Eastern Time the day before they're due. The IRS will also make available an e-file link on the IRS e-file website at so that you can access e-filed Forms 1040X as early as the day you file. The IRS will keep records of each e-file transaction, and if you get a refund, and it can be more than 24 hours later, you will still need to file an amended return. To electronically file, you can use any e-payment program, including Pay by Check and PayPal. File an electronic tax return..

Form 1040-x, amended u.s. individual income tax return definition

For example, if you filed an ITIN Form I-9, and you want a refund after one year, you must file an ITIN Form 1040, Form 1040-X or Form 1040-SS. An ITIN is an individual taxpayer identification number (ITIN). Unlike a Social Security number (SSN), an ITIN identifies an individual who lives in a particular country as the taxpayer. A child who was under age 19 and who was eligible to receive benefits under the TANK program under section 48(a) of the Social Security Act for a family of three, has the legal capacity to make decisions relating to his or her welfare, but does not have a legal resident alien status A nonresident alien individual who is not a citizen or national and who is not a nonresident alien of the for tax purposes may have an ITIN if: He or she is a nonresident alien who is an alien legally in.