Award-winning PDF software

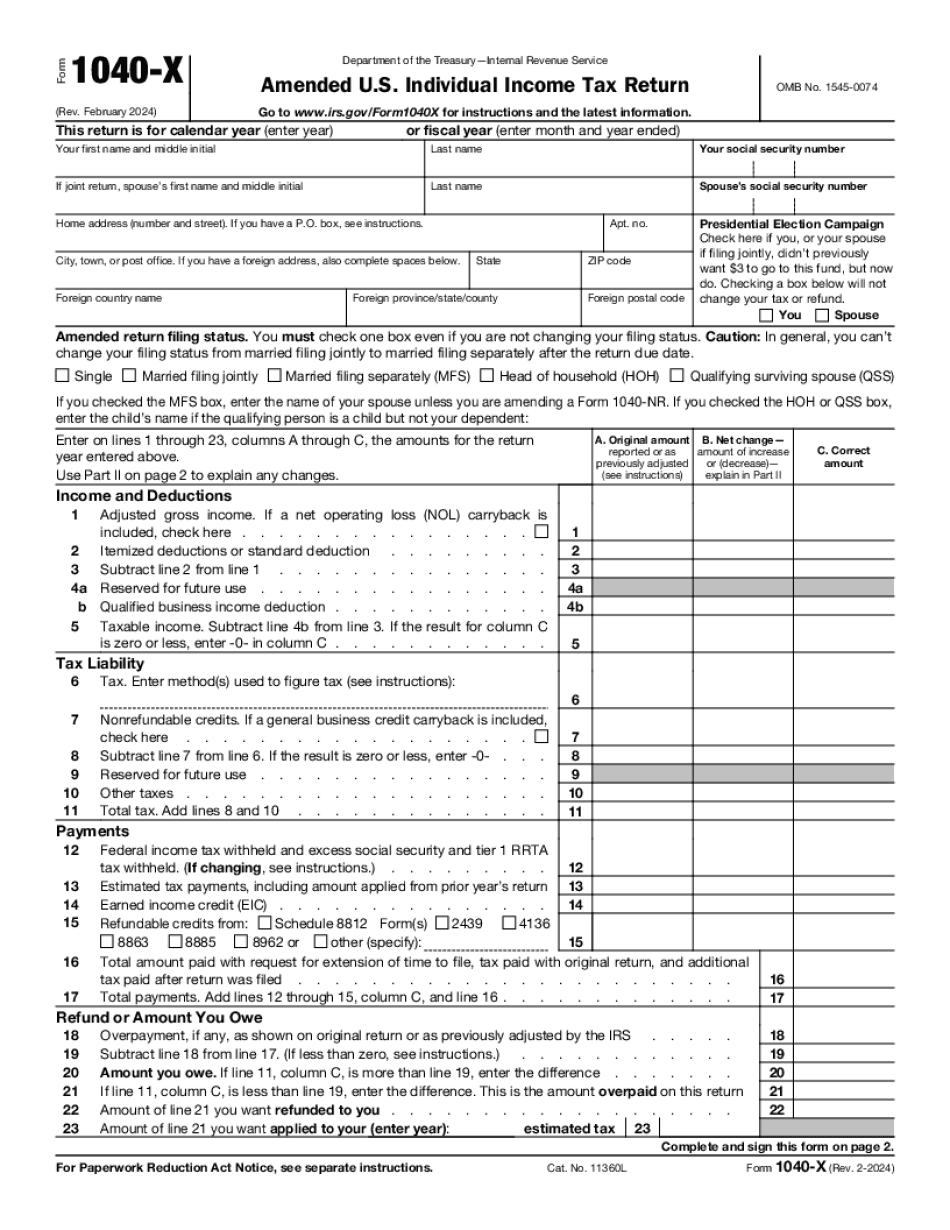

Abilene Texas Form 1040-X: What You Should Know

Taxation Update — eFile.com, IRS New Form 1040-X — eFile.com Tax Forms 2025 For Your City New 1040 Forms are now being released! 1040-XXX and 1040-XA forms are now being electronically filed every filing season by the IRS. eFile.com has prepared over 80% of the Forms filed in the past 2 years. It is the most trusted name when it comes to tax preparation and filing for the federal government and for corporations and their shareholders. How to File a Form for a Property Tax. This article will guide you through the important concepts, and rules that apply and provide explanations. It is important to understand all the terms, such as: The Basic Tax Calculation How the Tax Adjustment Works The Income Formula Form 3115 -- Income From a Retirement Plan Form 3116 — Mortgage Interest The Basic Tax Calculation There are several basic tax deductions that can be taken. These are: For the tax year 2025 through 2019, there are several rules that apply. The basic tax deduction amount is equal to: For individual taxpayers for 2025 through 2019. For married persons filing jointly for 2025 through 2019. For unmarried persons filing separately for 2025 through 2019. Here's what each deduction amount really means: Individual taxpayers have to include their net business income when figuring their tax, even if no deductions are taken on their business income. It is a tax deduction to provide for the individual's business expenses in preparing business income. For people that report their gross income from their businesses and salaries on their tax returns, the most significant tax calculation is the first two of the following three deductions: Interest: It is a tax deduction if someone has borrowed money to buy or build a business. The more money that is borrowed to buy or build a business, the greater the interest income when the business eventually earns income. Investing in an enterprise: There are tax deductions to use to invest your money to start up a business in any business line. The most common are: Interest on capital assets: The capital that is being borrowed is considered an 'investment' if it is more than the cost of operating expenses, but usually not more than the cost of investing the borrowed money in an investment. Interest on capital assets is usually an allowable deduction.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Abilene Texas Form 1040-X, keep away from glitches and furnish it inside a timely method:

How to complete a Abilene Texas Form 1040-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Abilene Texas Form 1040-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Abilene Texas Form 1040-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.