Award-winning PDF software

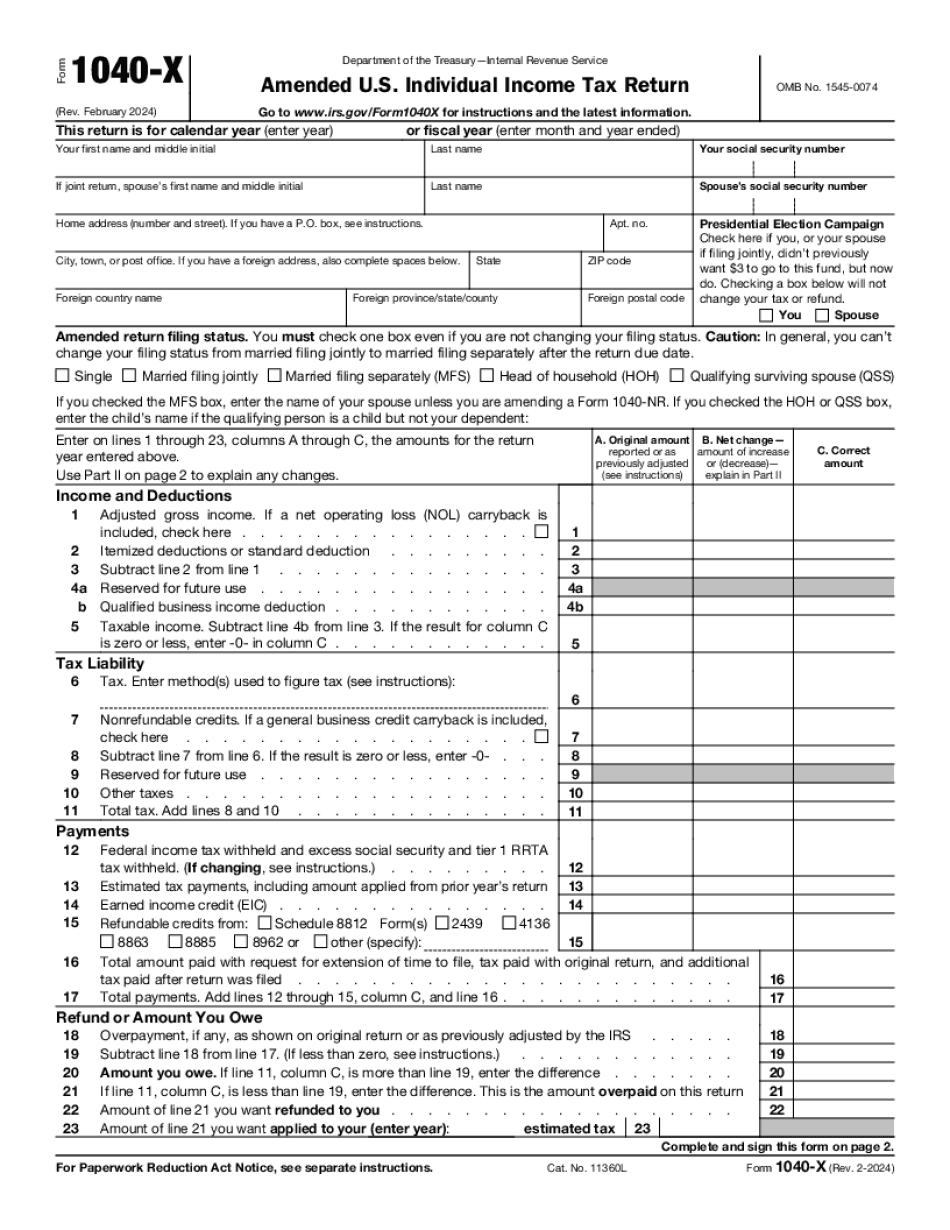

Form 1040-X for Frisco Texas: What You Should Know

H&R Block: Frisco, TX — Fax at least 8 pages for form de Form 1020-S or Form 1040-S. The IRS allows a person who satisfies the eligibility requirements to receive the reduced rate of tax on income of an unmarried dependent under age 24. Income Eligibility Requirements Form 1040, Individual Income Tax Return, and Form 1040-K (with Schedule A attached as if filed by a U.S. corporation) filed by individuals, the individual must have: His or her adjusted gross income, less all itemized deductions (and exemptions) of 61,050 for 2017 His or her home is an “honorable residence,” which the IRS calls “qualified rental dwelling units.” This term includes “apartment housing,” condominiums and similar types of real property. For 2017, the home must serve as a principal place of residence and must have been the source of the individual's principal place of business during the tax year. An unmarried and dependent individual eligible for reduced rates of tax under §1.199-11(g)(4) of the Code is also required to submit: An attestation of financial resources, signed by the individual's representative (if any) and on a form provided by the IRS; and A list of persons (or a description of the individual's principal place of business) who are or who have been his or her tax agents with an address that was active during the tax year. If the individual meets the requirements, the IRS will approve one amended Form 1040-X, and then one new Form 1040-X. All the information that was on the original Form 1040-X will remain on the amended Form 1040-X. The individual may use any income that was not adjusted for inflation to lower the adjusted gross income. Form 1040-X may be submitted once, after all necessary filings have been made, but a copy of the additional forms may be obtained by contacting the nearest IRS Tax Service Center and selecting “Online Help,” then “Forms & Publications.” To learn more about Form 1040X, see Publication 543, Amended Guide to U.S. Individual Income Tax. For a list of additional requirements that must be accompanied by amended Form 1040X, refer to the Instructions for Form 1040.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040-X for Frisco Texas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040-X for Frisco Texas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040-X for Frisco Texas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040-X for Frisco Texas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.