Award-winning PDF software

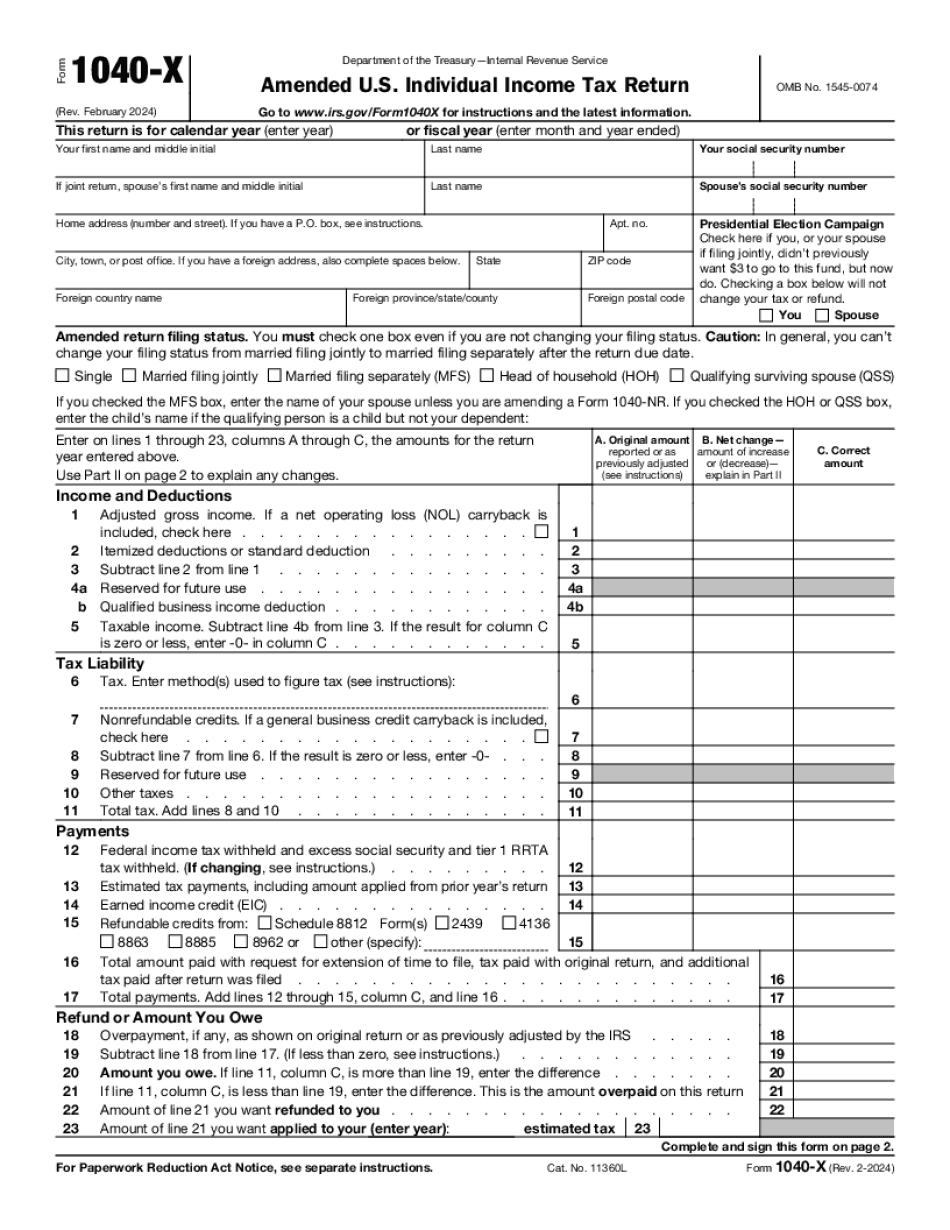

Form 1040-X online South Fulton Georgia: What You Should Know

Payments must receive a final payment prior to the scheduled August 15th deadline. 2018 Tax Notice The Revenue Officer's Office is reminding taxpayers not to pay any tax, interest, or penalty from July 1, 2025 – June 30, 2018. All current tax forms and the IRS 1040, Individual Income Tax Return Form S-1 are on hold until further notice. As previously reported, IRS Commissioner John Tolkien has requested more time to complete the tax forms. “The IRS needs to finish this year's tax return in a very short amount of time and without jeopardizing taxpayer services. The Taxpayer Protection Act is a law that provides Congress with the flexibility to ensure taxpayer compliance with the federal tax laws,” said U.S. Treasury Inspector General for Tax Administration J. Russell George. “Our federal agencies have a history of working together, and we will continue to work with the IRS on issues related to the completion of the tax forms with a view toward making them available for taxpayers as soon as possible.” The IRS is seeking the assistance of taxpayers from August 1, 2018, through May 31, 2019, in completing the 2025 year-end tax forms. The Revenue Officer's Office is asking taxpayers to have all tax preparers send completed tax forms to the Revenue Officer's Office, 501 W. Lake Street, Suite 4500, Atlanta, GA 30308. Taxpayers are reminded to complete and return all tax forms electronically so that refund processing can begin. Taxpayers who require assistance with information or instructions on the 2025 tax forms will be able to complete a free, online IRS training from IRS.gov/free. After the training, taxpayers can contact the Revenue Officer's Office or submit an additional Form 1040-ES at. The Office of International Tax Affairs will provide an online link for taxpayers to request information about international taxpayers or to request the form for international taxpayers after completing the training. Under the provisions of the Internal Revenue Code, the Internal Revenue Service is not required to provide a Form 1040-ES to taxpayers in situations where a taxpayer cannot receive a Form 1040-ES.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040-X online South Fulton Georgia, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040-X online South Fulton Georgia?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040-X online South Fulton Georgia aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040-X online South Fulton Georgia from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.