Award-winning PDF software

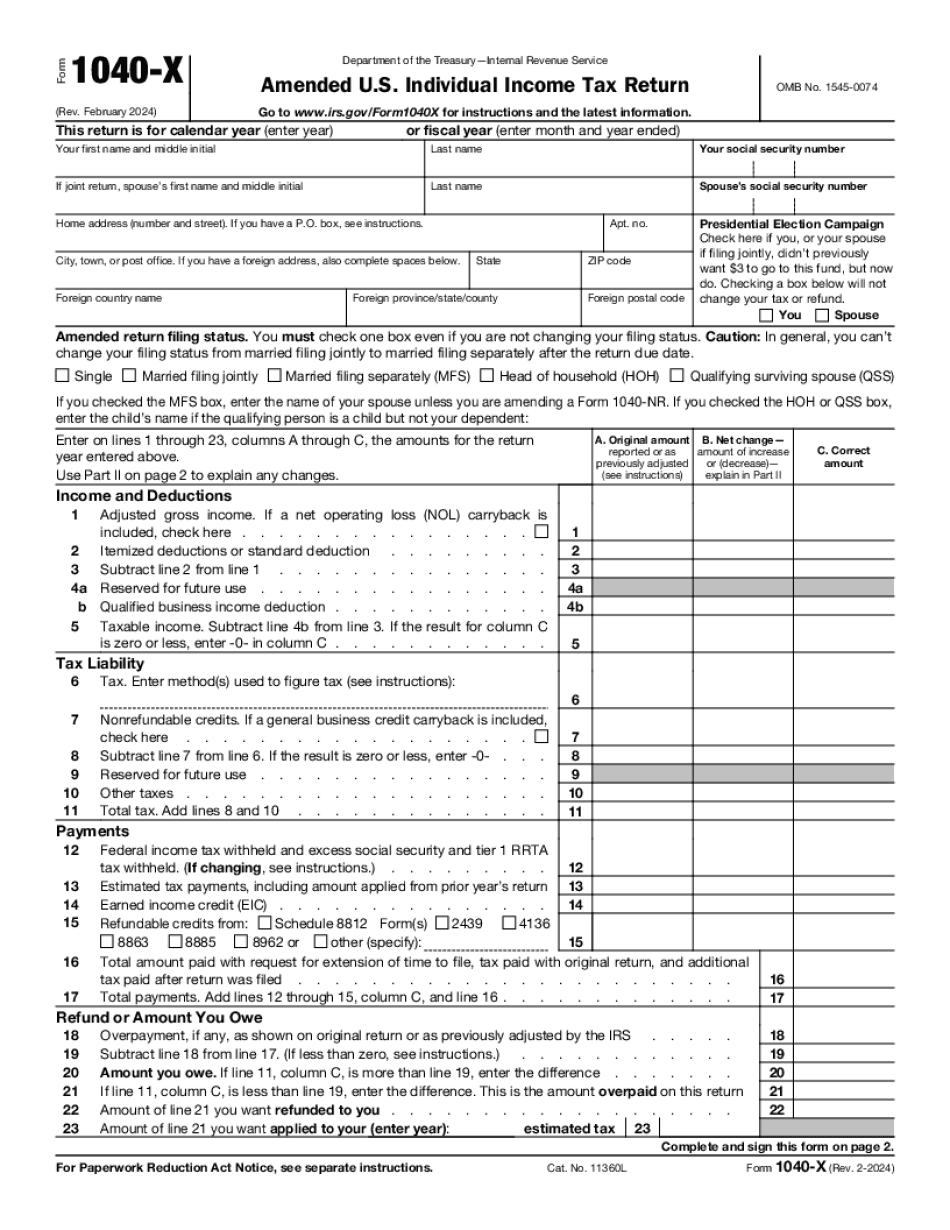

Hialeah Florida online Form 1040-X: What You Should Know

For the time being, we are not accepting new taxpayer information or completing new applications. Please contact the Taxpayer Assistance Unit in writing for service information. A few of the tax questions currently in the news: Are there income tax consequences if I pay my child's college tuition with another child's college money? If the child is already enrolled in college at the time she gets the tuition, she may get no aid. I am paying tax on a house for a family with a home office, but I have a separate business which we own and used to run. What can I do? You can continue your business' exemption by making the following claims on Schedule C to your return: A. Business expense of the separate business used separately from your home business A deduction for depreciation to offset business expenses. If you take the depreciation, then your home business will be adjusted to nil. B. Expenses for business property that you own separately from its use by you to run your own separate business B, C or D. If you take the allowable deductions for you home business, add the amount of deductions for your separate business to your total. Who can claim the standard deduction for my sole proprietorship? You can claim the standard deduction only for those who meet the following requirements: I'm married to someone living in Mexico, and we are filing jointly. Will my US income tax be due on me even though I don't live there? Yes, if you were married prior to November 5, 2011, and file an individual tax return for 2012, your US income tax will be due on November 15, 2012, on all income. I paid personal income tax withholding at the post office last year. Is that the same as paying personal income tax on my business income tax return? Yes. The IRS requires you pay either personal or business income taxes to the appropriate IRS address. The IRS has made a change in how refunds will be given and mailed. If you are a business owner and file a Tax Return, you will need to send a copy of your return to the proper address on your tax return. This copy must be sent through the mail. If you are paying payroll tax, how will I calculate payroll tax refunds? Your payroll tax refunds will be calculated based on your business income tax. If you are a business owner and file Form 4562, will the IRS contact me immediately when I have overpaid my business tax liability? No.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Hialeah Florida online Form 1040-X, keep away from glitches and furnish it inside a timely method:

How to complete a Hialeah Florida online Form 1040-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Hialeah Florida online Form 1040-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Hialeah Florida online Form 1040-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.