Award-winning PDF software

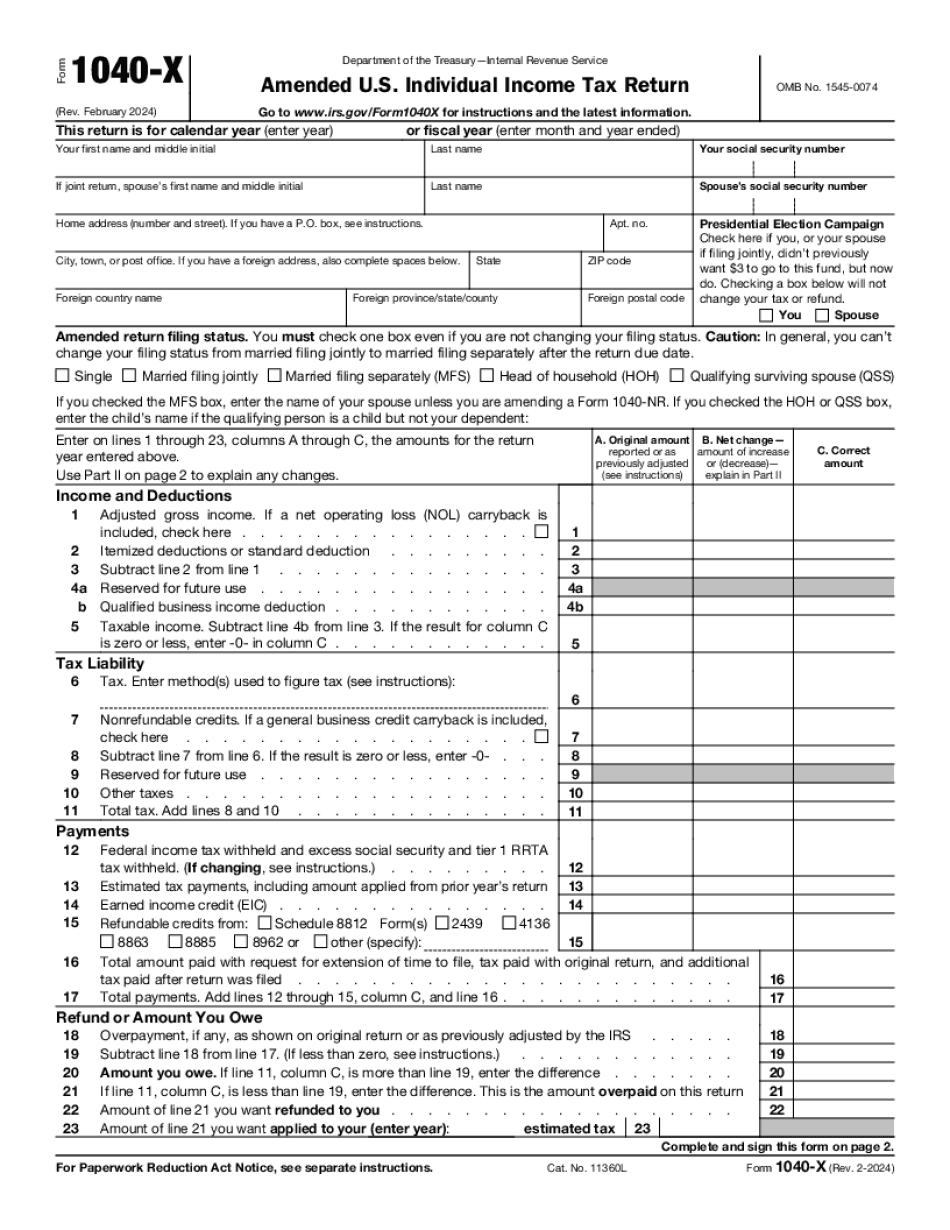

Huntsville Alabama online Form 1040-X: What You Should Know

Pub 15‑CPublicationPublication for 15‑CPubl 22‑PPublicationPublication for 22Publ 25‑PPublicationPublication for 25Publ 15‑SPublicationPublication for 15Publication for 30 Publication for 15. Pub 22‑APublicationPublication for 22 Publication any other tax related information, please visit the “About Your Account” page at H&CLocalc.org, or call. If you are a taxpayer with questions about your filing status, please contact the department at 5th Floor, The Huntsville Tax Exam Center, Main Room, 1801 North 5th Street. Disclaimer: For Federal Tax purposes, you have the ability to be listed for withholding, filing, and estimated tax purposes as a small business. We understand the value of this right to our clients. If you would like for your situation to be considered as a small business and do not wish to be listed for filing, please contact the department to have your name added to our contact list. How to Get the Most out of Filing Tax Form 1040 Tax Form 1040 is a tool that is designed for the purpose of filing individual U.S. taxes. It is not intended to be a tool to prepare you for filing any federal, state, or local government tax. Tax form 1040 can be used as a pre-tax report or post-tax report, in which case, there are differences depending on the type. How to Prepare for Your Filing Requirements Download the tax form 1040 by using the Tax Preparer Tool at. You will be asked to choose the year, and you will be asked to file. You will also be asked to enter the address where you wish to be mailed the form. Once the form has been electronically filed, you will receive an e-mail that will include all your tax documents. This information will guide you as you prepare the necessary tax information. Download the Form 1040 by using the Tax Preparer Tool. Download the Form 1040-EZ if you are claiming Certain Business Exceptions, or the Form 1040-ES if you are claiming Certain Self-Employed Individuals Exclusion. Download the Form 1040-S if you are claiming the standard deduction or itemized deduction. Download the Form 1040-A to calculate your Adjusted Gross Income.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Huntsville Alabama online Form 1040-X, keep away from glitches and furnish it inside a timely method:

How to complete a Huntsville Alabama online Form 1040-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Huntsville Alabama online Form 1040-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Huntsville Alabama online Form 1040-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.