Award-winning PDF software

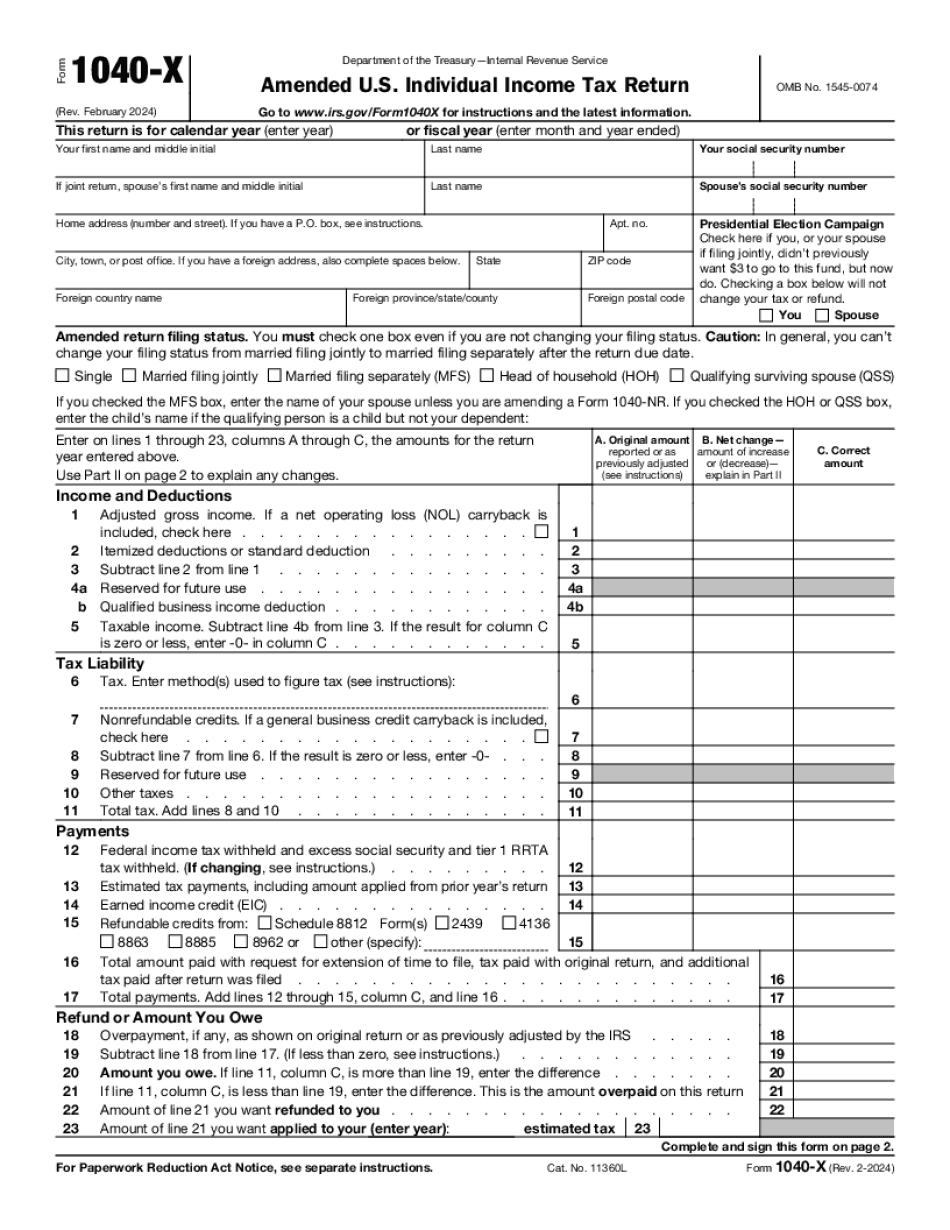

Meridian Idaho Form 1040-X: What You Should Know

Taxable interest income is subject to tax. Meridian, ID is home to one of the fastest growing populations of young adults in America. We've got young professionals living in our area who are graduating from our colleges and universities. In addition to these young professionals, we have an impressive number of high income individuals and families. These people are making money through their investments in Meridian and, on this side of the river, we have very few places to reinvest their accumulated wealth while they wait until they are older to pass it on to their children and grandkids. So don't let the lure of the “new” meet with an empty wallet. Get involved with our free Meridian tax seminars now. You won't regret it! Taxes can be a pain and can be an excuse for not doing your taxes. If something's frustrating and confusing for you, do one of the following to get the details: Take a look at . If all else fails, contact a qualified local tax counsel to help you complete your return, including the Free 1040 Form. Or check here: See all of our Northwest Tax Advice articles If you do any of the following, you will get a refund of the penalty and the deficiency in no more than 10/12 months. In addition, you can get all the credits you can. The penalties for the tax year 2025 are: — 195 for Schedule A of the Alternative Minimum Tax — 2,500 for the Additional Medicare Tax — 695 for the self-employment tax — 195 for Schedule F of the Alternative Minimum Tax The tax credits for the tax year 2025 are: — 300 for Earned Income Tax Credit — 600 for American Opportunity Tax Credit — 1,000 for Additional Child Tax Credit — 500 for American Opportunity Tax Credit (for unmarried parents) — 700 for American Opportunity Tax Credit (for married filing jointly) Please note: You may call the City of Meridian, ID Revenue Department to: Tax Counseling for a non-federal debt Tax counsel help the taxpayer complete and file their tax return. The Tax Counseling is available Monday – Friday, 8:00 AM to 6:00PM on the following hours: Monday – Friday, 8:00 AM to 1:00 PM, except Federal Thanksgiving and Christmas Day.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Meridian Idaho Form 1040-X, keep away from glitches and furnish it inside a timely method:

How to complete a Meridian Idaho Form 1040-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Meridian Idaho Form 1040-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Meridian Idaho Form 1040-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.