Award-winning PDF software

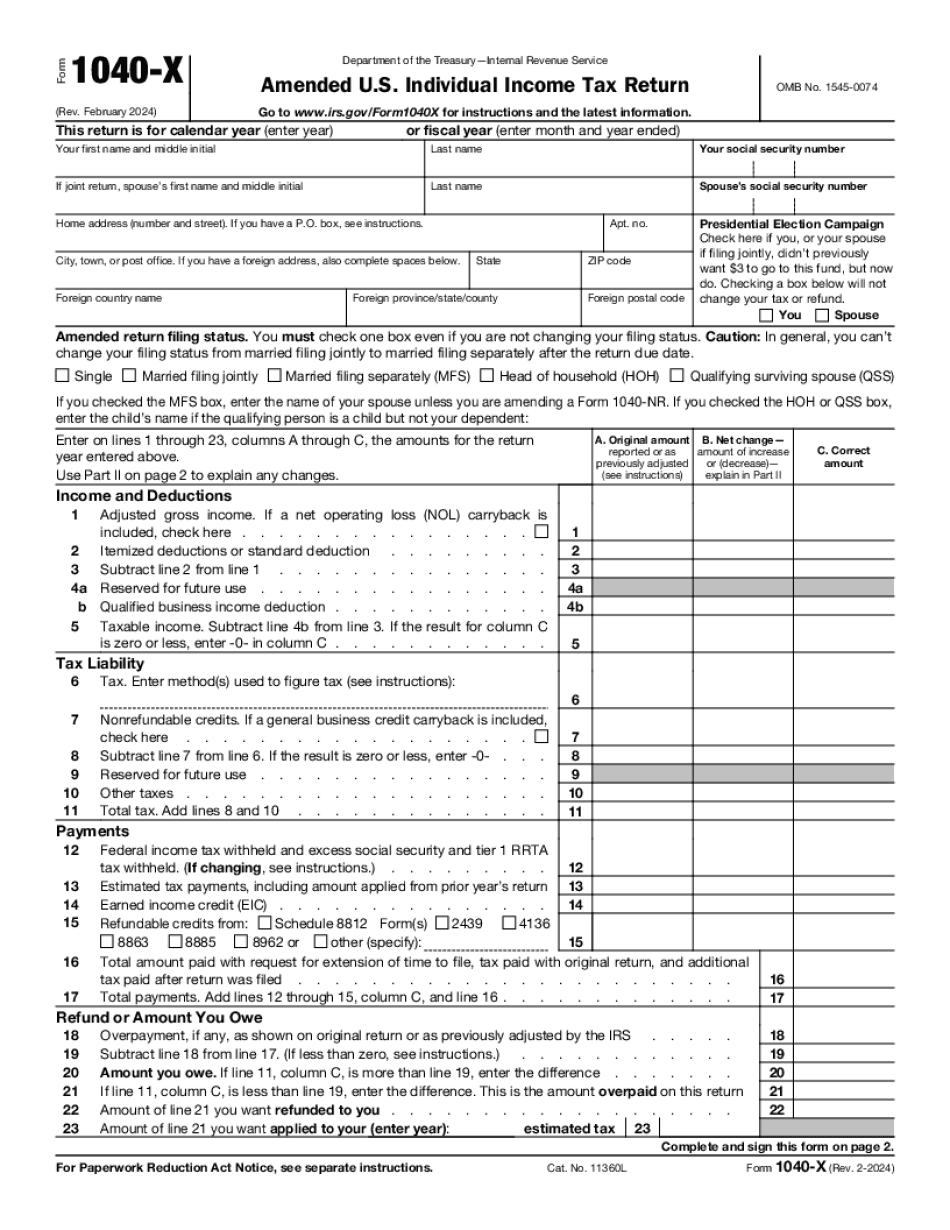

Toledo Ohio Form 1040-X: What You Should Know

Form 8889, Tax Withholding Information for Aliens and Legal Permanent Residents Information about Form 8889, Tax Withholding Information for Aliens and Legal Permanent Residents, including recent updates, related forms and instructions on filing. Form 1040-X and Form 1040, Amended U.S. Individual Income Tax Return for Individuals With Respect to Individuals Electing to File a joint return and filing a tax return jointly. Form 1040-X and Form 1040, Amended U.S. Individual Income Tax Return For Individuals Electing to File a Joint Return and Filing a Tax Return Jointly. Form 1040-X and Form 1040, Amended U.S. Individual Income Tax Return for Individuals With Respect to Certain Partners and Certain Reporting Partners. Form 2043-T, Return of Credit for Business Use of Aircraft by Individuals, Hardship Exemptions: Certain General Contractors, and Certain Individuals Expensing Property. Am I Taxed on my In-State Auto Sales Tax? You may be charged taxes on your in-state sales taxes after you move to a new state. You need to know if that's true. The answer: It depends. You can claim the state sales tax you paid during the calendar year the car was rented, leased or sold; if the rental, lease or sale was in the same state and if the car was available for use in Ohio. A few things to know about car rentals: Renting a vehicle or leasing it is the first time you're using it. If you're renting in Ohio, you'll be taxed up to the difference between the local sales tax rate in your new city and the rate in your old city. If you're leasing, you don't pay the Ohio sales tax. You pay state income tax on the lease value. Remember—if you rent a car in Ohio, you'll pay the county sales tax even if you live in another state. If you're paying for parking in Columbus or Columbus-area cities, parking may not include metered or metered-provision (sometimes called “discounted parking”). Some state and local government agencies charge parking rates using the general rate. If that happens, you may get hit with Ohio's parking sales tax. However, this applies only in specific situations, and you might still be able to save money. Remember—cars aren't taxed when you use and maintain them in your home.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Toledo Ohio Form 1040-X, keep away from glitches and furnish it inside a timely method:

How to complete a Toledo Ohio Form 1040-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Toledo Ohio Form 1040-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Toledo Ohio Form 1040-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.