Award-winning PDF software

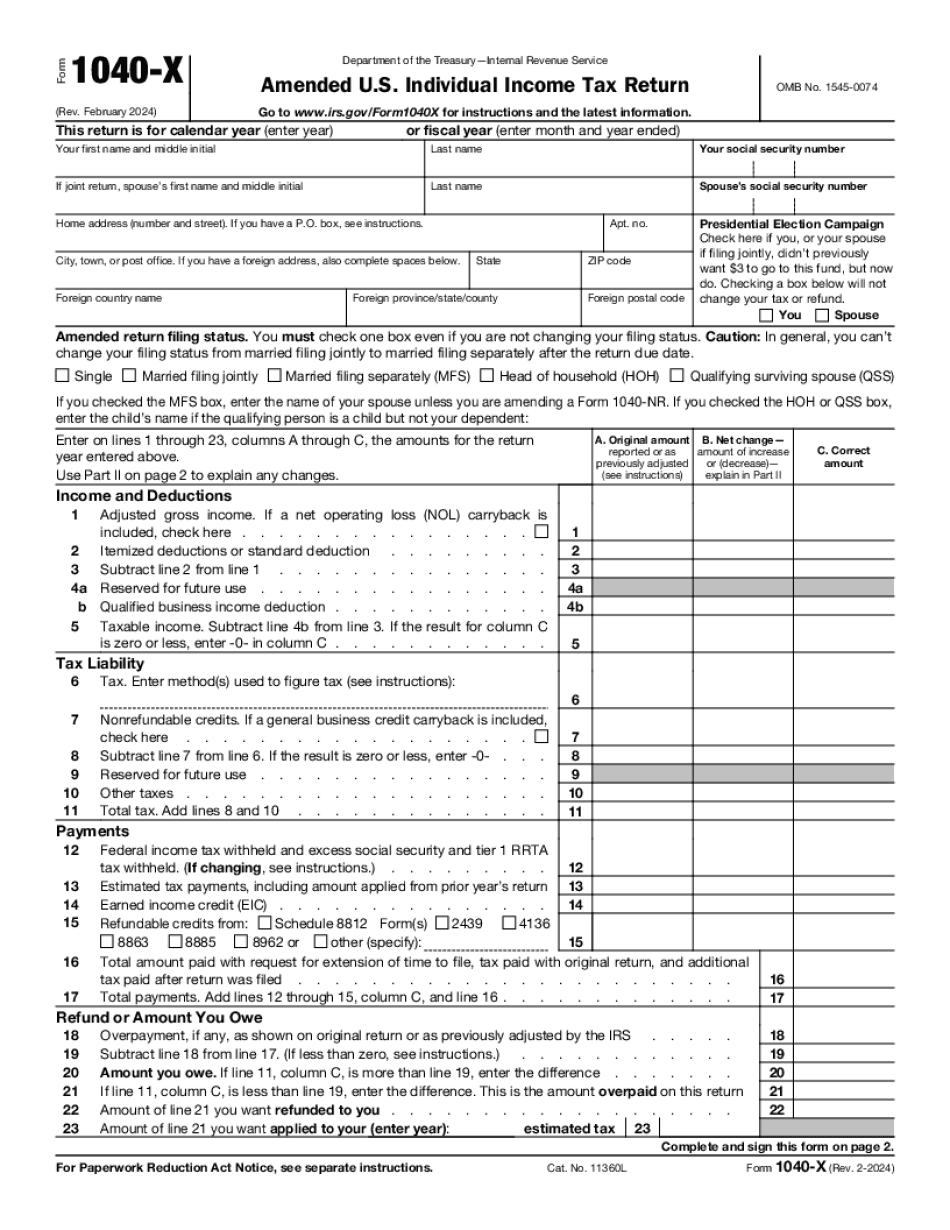

Form 1040-X Texas Dallas: What You Should Know

Austin, Texas 78701, should be changed to “University of Texas at Dallas — TX Campus, 700 West Campbell, Austin, TX 78704.” It is the official office of international students and their families. You are not to send any information from your university to this office. This office will only process requests via email. Emailing or faxing information directly to the Taxpayer Assistance Program is not allowed. This office accepts requests within 90 days of the enactment date. Tax Forms — International Students and Scholars Office. Taxpayers and Tax — IRS August 31, 2025 — The IRS office in New York City sends an email to advise taxpayers of a new “form 943a” that requires all employers to file the I-9 and pay the Social Security and Medicare taxes. We are not aware of IRS changes impacting Texas taxpayers. Free Tax Help! — Dallas Public Library It's commonly referred to as the Tax Cuts and Jobs Act, TCA or tax reform. Form 943a is updated to require employers to file the I-9 and pay the Social Security and Medicare taxes. Taxes — International Students and Scholars Office If you would like guidance on this form, please view the video below: Form 8977. “I Am An Individual” Form. The IRS sends this in May and July to all businesses and professional organizations that will be filing Form 8993 electronically in the upcoming year. The following is an example of the form: I Am An Individual A. Name; B. Address; C. Telephone number; D. Fax number; E. Date of birth; F. Gender; G. Employer identification number; H. Email address (if available); I agree to the procedures set forth below. You, a business owner, are hereby notified that beginning on the first day of July 2016, the Form 8993 form, with this accompanying document, will be required to be filed electronically through the U.S. Department of the Treasury's Electronic Federal Tax Payment System (FTPS). By filing the Form 8993 using the FTPS online system, tax will be collected (FTPS is free) and remitted electronically. If you use other forms of filing, you must continue to use the FTPS service. This mailing address is an internal IRS address only. The Taxpayer Assistance Program has information about many tax issues for international students and their families.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040-X Texas Dallas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040-X Texas Dallas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040-X Texas Dallas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040-X Texas Dallas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.