Award-winning PDF software

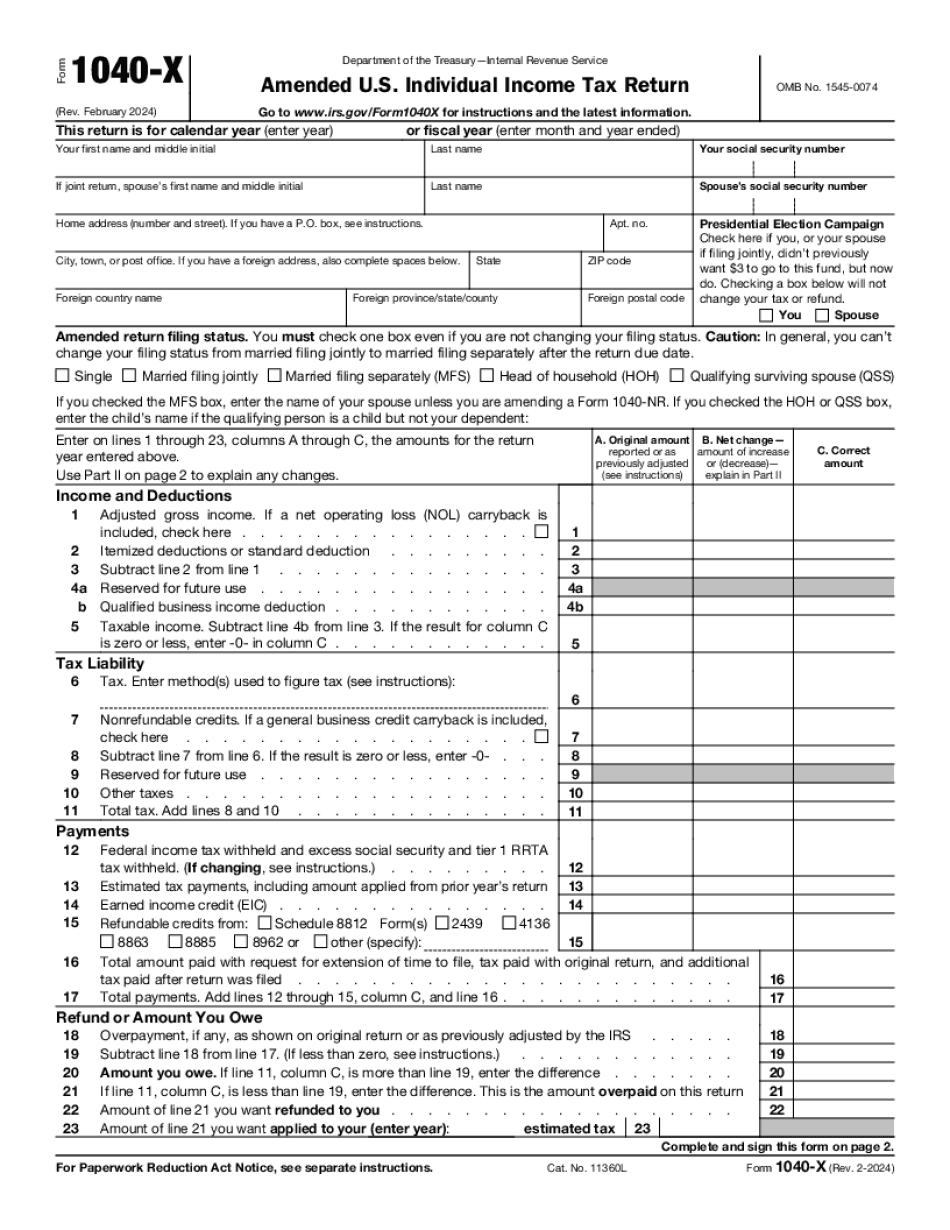

King Washington Form 1040-X: What You Should Know

The IRS is refusing to accept some tax advice this year. This guide describes the most common types of tax-related problems and what to do to fix them. It is particularly helpful for small-business owners. A reminder from tax day: Make sure to keep track of your income. It's not tax-filing season yet. However, the IRS sends people a notice about filing taxes by January 20, and asks for proof of income every year. This guide provides a little general guidance for people who may be facing a small business tax problem. If you're not aware of where your money is going, you may not be able to handle paying it! In January 2025 the District of Columbia joined the State of Washington in asking the IRS to stop charging business owners to file federal small business. The IRS has responded: they can only charge for services the IRS deems “tax-exempt.” Here's the response: “The Internal Revenue Code does allow taxpayers to obtain an electronic signature for certain government agency service forms, as long as such electronic signature is not deemed 'tax-exempt'.” The DC Attorney General sent a “cease and desist” letter to an IRS official on January 29, 2011. That notice includes: “The District of Columbia is in receipt of your letter dated January 29, 2011, instructing the Internal Revenue Service (IRS) to cease and desist from its enforcement of Section 5702(d)(1) of the Internal Revenue Code (“Code”) (“the Code”), which requires payment of an estimated 20 to 30 in fees for any Form 941-EZ filed with the District of Columbia after April 2012.” Here are links to two important reports. I have to tell you that I've never been more relieved to receive a mailer from the District of Columbia Attorney General for filing their federal taxes. And so here's a link again to my post on filing your taxes this year. Here are some links to other useful information about filing your taxes. Filing taxes should not cost you a penny. This is very important to remember. Many times we pay a tax just to get a letter from the IRS asking us to fill out an additional form. We pay these fees because of how difficult it is to take advantage of tax-filing services or write a personal or corporate letter. Don't forget: all tax laws are enforced through the collection service.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete King Washington Form 1040-X, keep away from glitches and furnish it inside a timely method:

How to complete a King Washington Form 1040-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your King Washington Form 1040-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your King Washington Form 1040-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.