Award-winning PDF software

Kings New York online Form 1040-X: What You Should Know

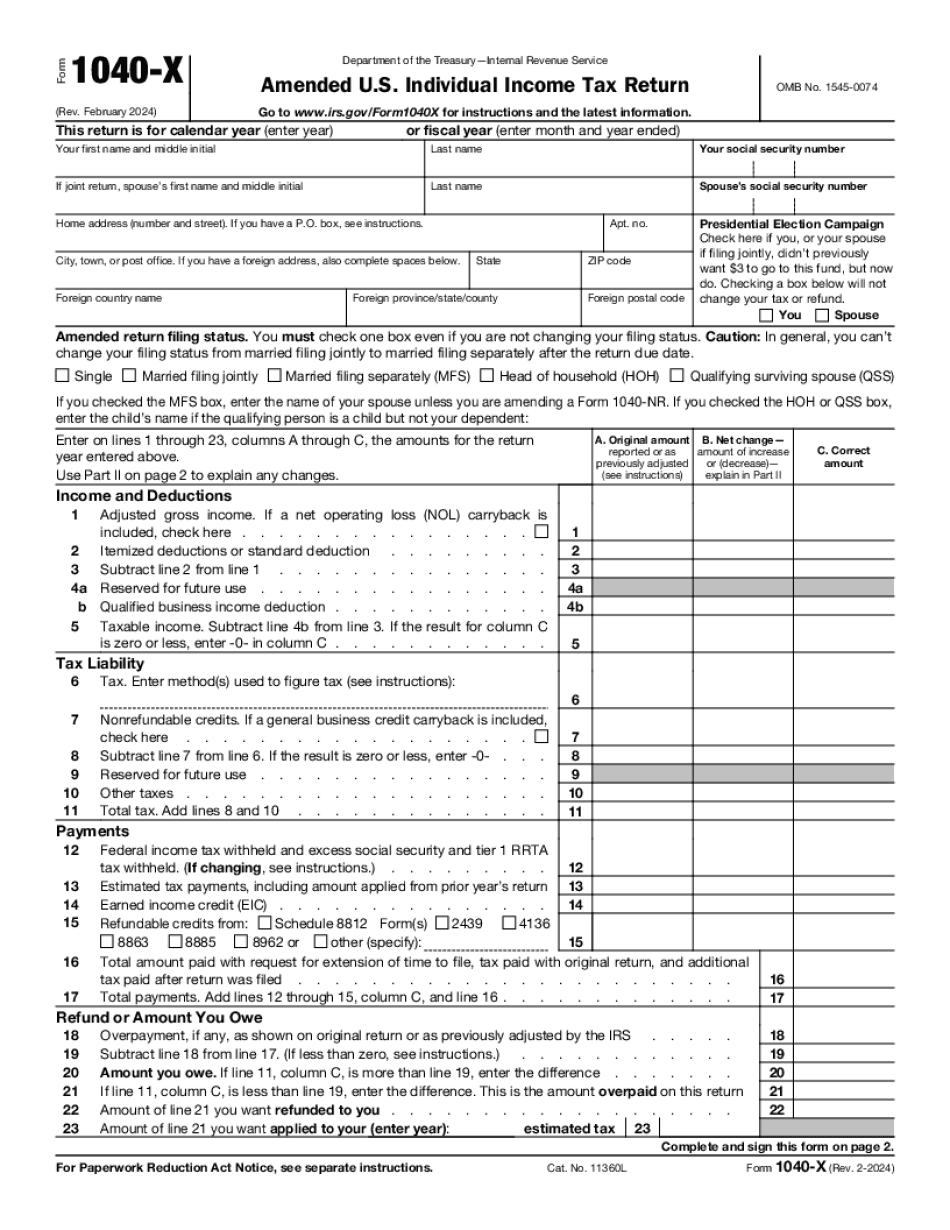

Form 1040X for calendar year (enter year) tax returns, many individuals overlook that fact. If you fail to file or correct a refund claim by April 15, the IRS has two options. First, the IRS could tax you on that missed filing, and it could also cancel your credit and refund you the following year. Second, the IRS has the power to deny your refund, and most taxpayers do not contest a refund denial. As we can see from what happens on this page, if the IRS determines there were deficiencies, you can lose your refund. Here, we'll take a look at what is usually expected in the event that you should not comply with the filing deadline to file your tax return. New Year's Day Is the Deadline to File an IRS Form 1040X It's difficult for taxpayers to miss the deadline to file a tax return. The only exception is the “Amended” (see below) form. While it is not unusual for taxpayers to complete their returns by the normal filing deadline, it is possible that the IRS may need time to audit a case. In that case, if you should not comply the first time, and you should wait until the end of the year, then April 15 may still be a reasonable date. However, if you intend to file an amended return, there are many considerations you should consider before making that decision. To file the “Amended” return, you may have additional considerations. “Alarm Clause” — If you are planning to file the “Amended” return, you should consider filing the form on or before the 15th of April. There is an “Alarm Clause” that could come into play in the event that you fail to file by the due date. When the IRS assesses the deficiency against you, you may be required to pay penalties and interest. If the IRS withholds any amount from your refund, it may become an interest or penalty payment. There is no guarantee that the deadline will be met, and a reasonable person would be reluctant to pay the taxes due without a guarantee that the return will be filed before April 15. “Deadline of Last Return — Last-Return-Required — It cannot be stressed enough that the “Deadline of Last Return — Last-Return-Required” is the deadline for the last return you filed. If you have a filing system that can “track” your payments and deduct them from your last returns, then you are able to avoid the dreaded “Deadline of Last Return”.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Kings New York online Form 1040-X, keep away from glitches and furnish it inside a timely method:

How to complete a Kings New York online Form 1040-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Kings New York online Form 1040-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Kings New York online Form 1040-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.