Award-winning PDF software

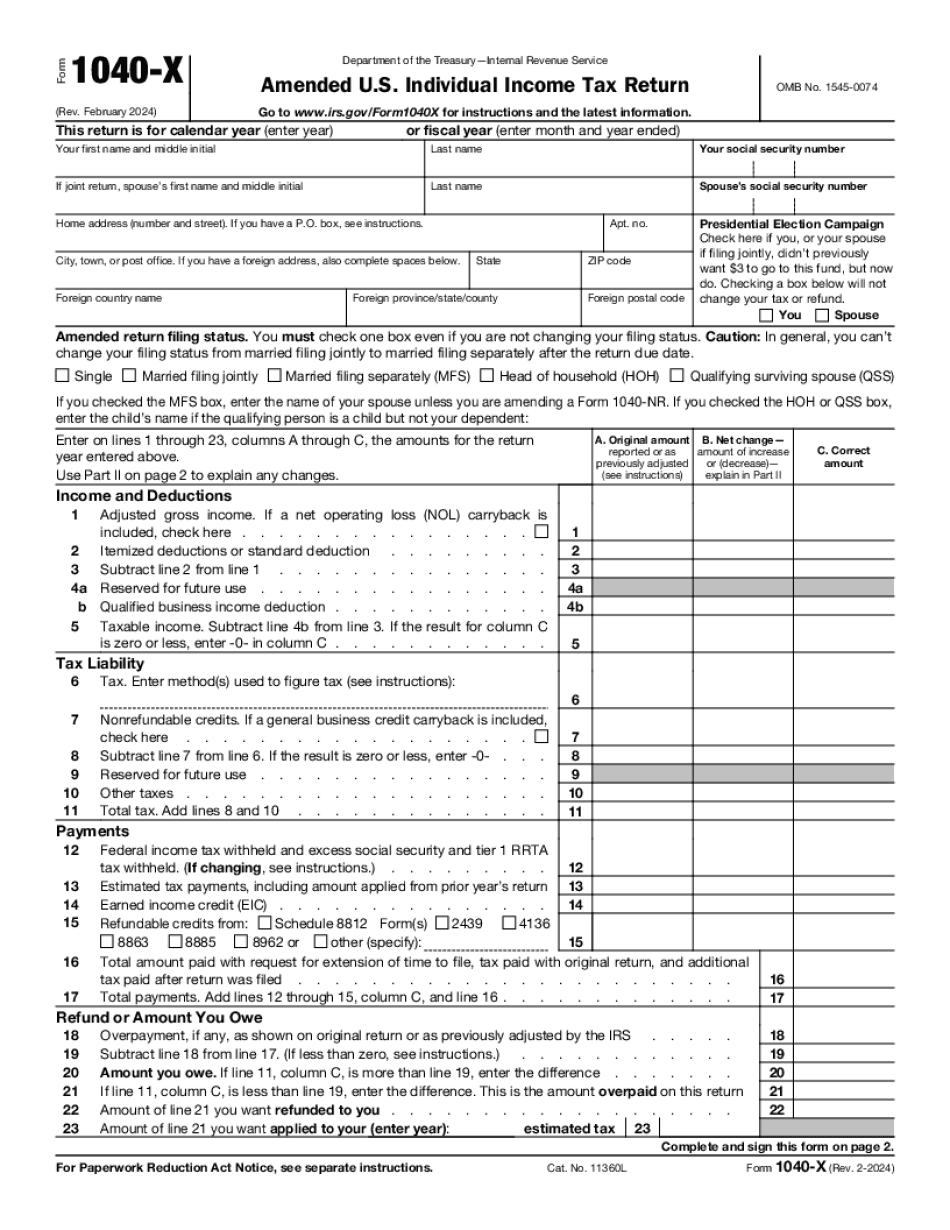

ID Form 1040-X: What You Should Know

NJ Tax Payment Request NJ-1040X. 2025 — 9x. SIGN HERE. Under penalties of perjury, I declare that I have examined this return, Firm's Federal Employer Identification Number. Form 8861: NJ Taxpayer's Electronically Filed Return for Estimated Tax or Credit This form is not to be used for any tax payment request. 2026: Individual Income Tax Return Form 8781 — NJ Individual Tax Return (Form 8781EZ) Here's how to use it: Enter your address, your NJ social security number, and your NJ EIN. Under the instructions for Form 8781, complete Schedule A and fill in your estimated tax or credit amount. 2028: Alternative Minimum Tax Return Form 8861 — Alternative Minimum Tax Return (Form 8861EZ.) Form 8861 is used for filing a return if you're subject to the Alternative Minimum Tax. The AMT is a tax on people with high incomes. 2031 Employer Identification (EIN) Adjustment Form 8962 — Employer Identification (EIN) Amended Return 2054: 1040 Income Statement 1040-EZ: If your adjusted gross income falls below a certain level, you may owe the Alternative Minimum Tax. Here's how to file your tax return (Form 1040). 2055: Self-Investment Income Tax Return (Form 8861-S) Income information is used to report self investment income on Form 8861-S 2057/2058: Return for Tax-Exempt Organizations (Form 8958) This form is not to be used for any tax payment request. 2064/2065: Individual, Employer, and Business Income Tax Return (Form 1040-ES) Here's how to use it: Enter your address, your NJ social security number, and your NJ EIN. Under the instructions for Form 1040-ES, complete Schedule A and fill in your self-employment income and employment income. 2066: Tax Information Return (Form 1040-EZ) 1040-EZs file electronically. Under the IRS instructions, you will need to complete Form 1040-EZ. Apt.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete ID Form 1040-X, keep away from glitches and furnish it inside a timely method:

How to complete a ID Form 1040-X?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your ID Form 1040-X aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your ID Form 1040-X from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.