Welcome to Tax Teach. I hope you're all having a great day. My name is Sean, and I'm a certified public accountant specializing in taxation. Today, I want to talk about how to fill out Schedule 8812, the Child Tax Credit schedule. To receive the child tax credit, which can be as high as $3,600, if you have children aged 5 and younger, or if you have children aged 6 to 17, you can get up to $3,000 for the 2021 tax year. Without further ado, let's dive into how to fill out the Child Tax Credit Schedule 8812. Alright, here's Schedule 8812, "Credits for Qualifying Children and Other Dependents." In this example, I'm going to assume the taxpayer, Jane Doe, is a single mother of two children - one child being five years old, and the other being eight years old. With that fact pattern, I'm going to go over how to fill out this schedule. Part 1 - A: Child Attachment, Other Credit for Other Dependents Line 1: Enter the amount from line 11 of your Form 1040. This is your adjusted gross income. For this taxpayer, we're going to assume there was $50,000 worth of adjusted gross income for the year. Lines 2a through 2d relate to if you worked overseas throughout the year. There's a bit more complexity to calculating the child tax credit if you did work overseas throughout the year. However, in this example, I'm going to assume that the taxpayer lived in the United States throughout the whole year and didn't make any income overseas. It's okay if you go on vacation to a different country. Lines 2a through 2d really relate to if you were working overseas. So, in this example, I'm going to assume that the taxpayer didn't. Line 3 is a summing line. Sum line...

Award-winning PDF software

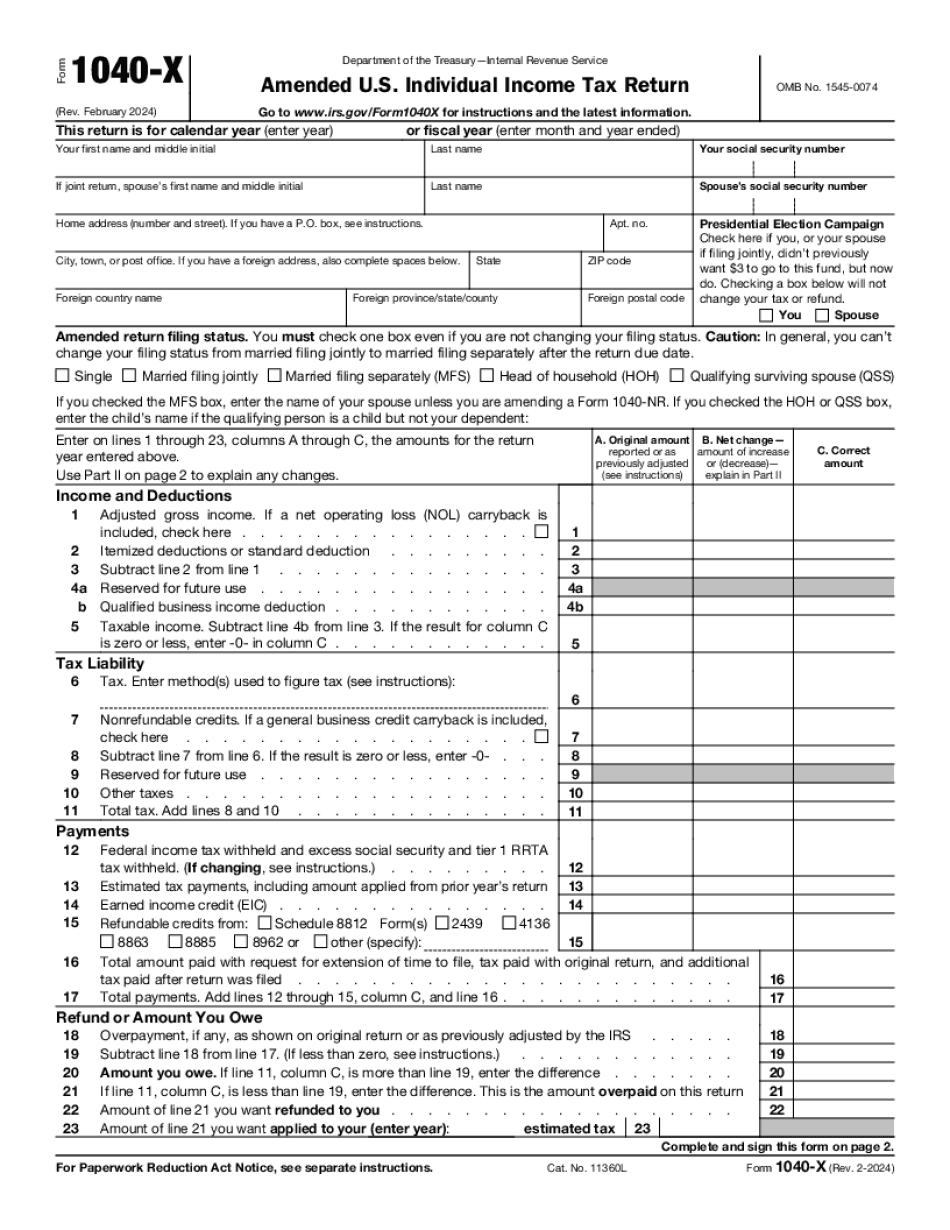

Video instructions and help with filling out and completing Form 1040-X vs. Form 1040 Schedule 8812