Let's quickly have a conversation about form 1040x. I want to give you line by line instructions. Don't go anywhere, you're going to love today's conversation, I guarantee it. Welcome back, folks, to another edition of the awesome circuit show. How are you today? I hope you are doing fantastic. I'm doing marvelous. If you ever ask me if you are doing as great as I am, go grab a cup of coffee or tea or vodka. Let's roll. In today's conversation, I want to talk to you about form 1040x line by line instructions. But before I get into the actual step-by-steps, please, I want to talk about some fundamentals. So, if you are here only for the line by line instructions, you want to fast forward this video to about six to seven minutes, okay? But it's important to talk about the definition, what is an amended return? Because when we speak about form 1040x, we are speaking about form an amended return, right? This is a form filed in order to make corrections to a tax return from a previous year. So, an amended return can correct errors and claim a more advantageous tax status, such as a refund. For example, you might choose to file an amended return in instances of misreported earnings or tax credit. So, that's the definition, what is the target audience? So, in other words, who should file an amended return? All taxpayers are required to file their taxes annually for the previous tax year, right? Everybody understands that. Taxpayers may realize that they made a mistake in filing out their tax forms or their circumstances may have changed after they have submitted or mailed a return that has been accepted by the government. So, if you have mailed your return to the IRS and...

Award-winning PDF software

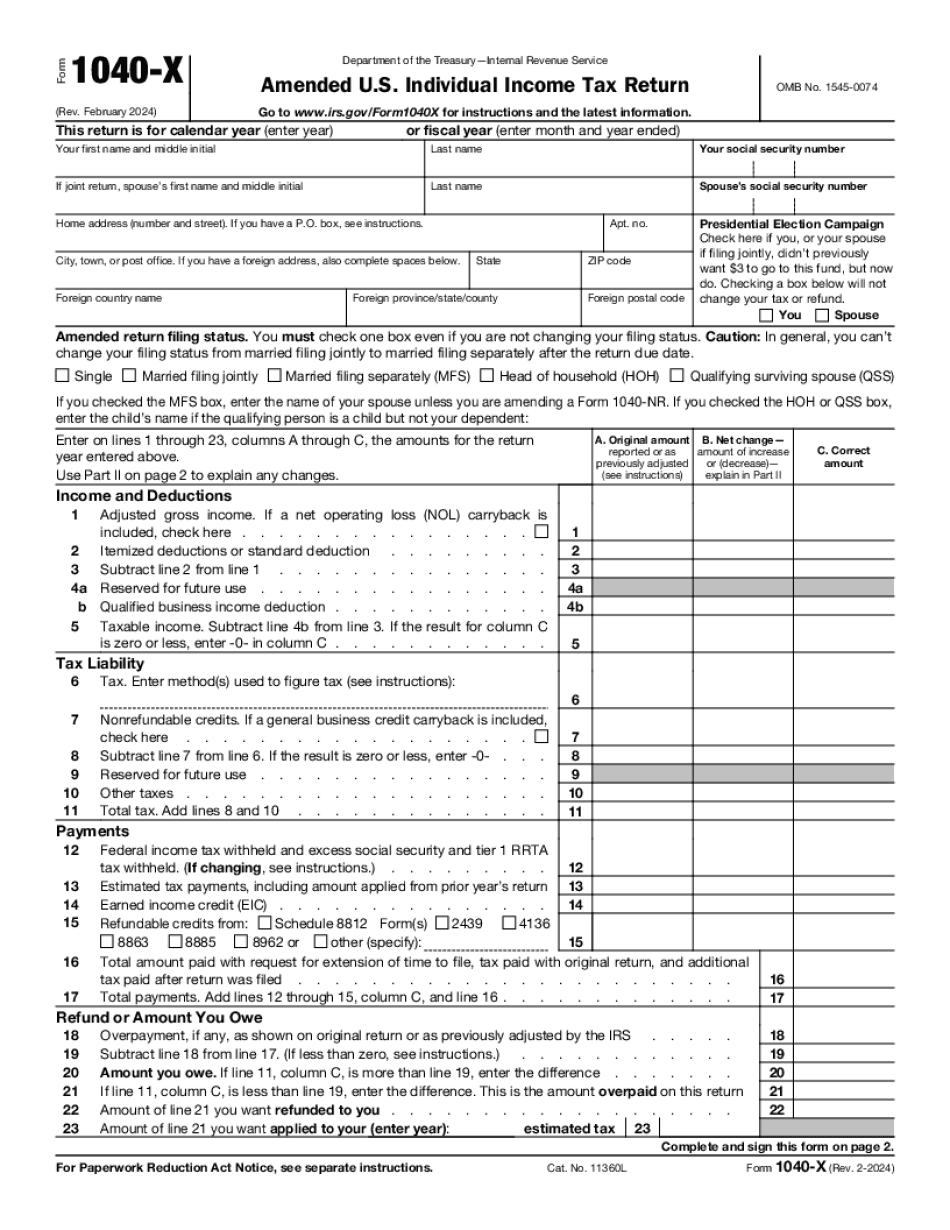

Video instructions and help with filling out and completing Form 1040-X vs. Form 1040v