PDF editing your way

Complete or edit your 1040x form anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export 1040x directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your 1040x form 2021 as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your 1040x form 2020 by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

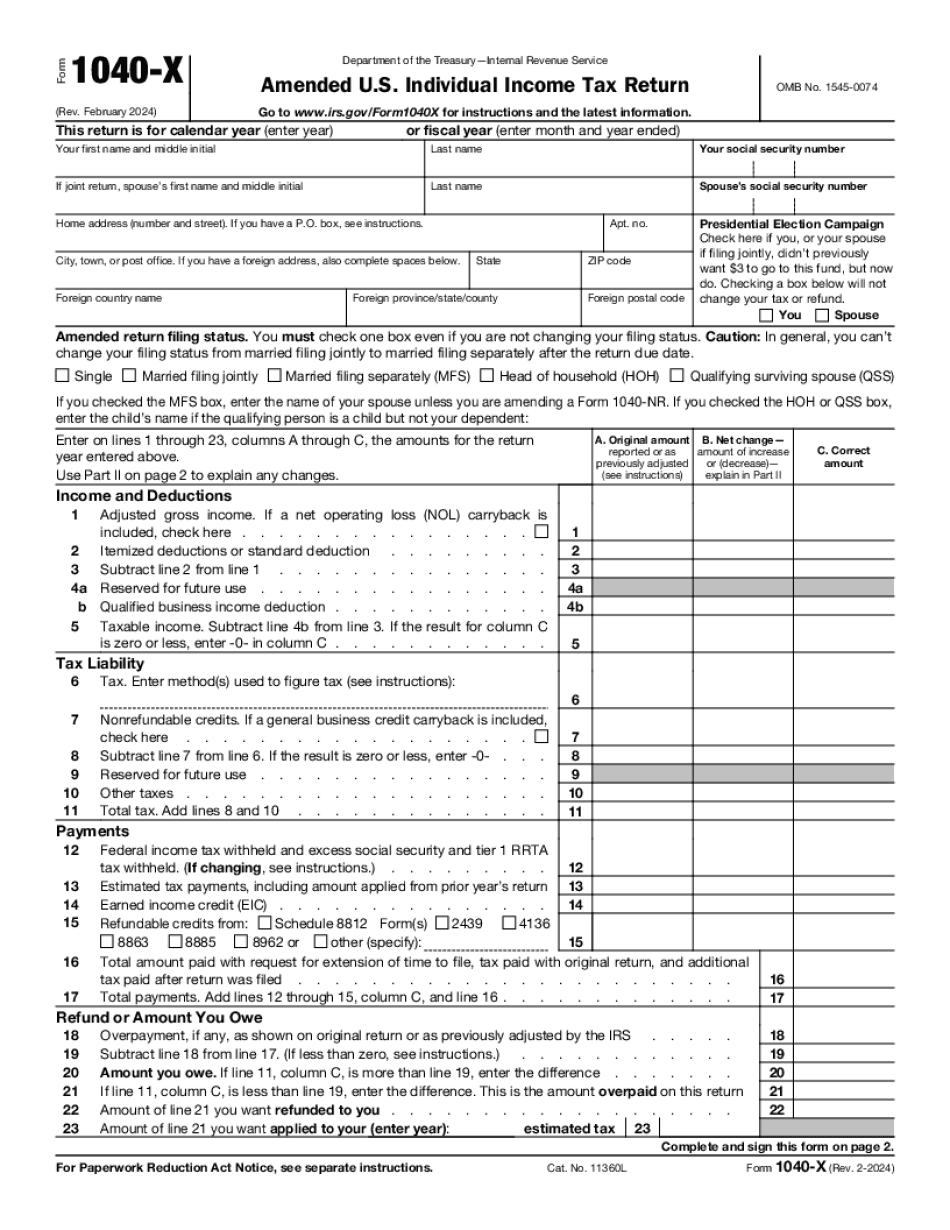

How to prepare Form 1040-X

What Is 1040x?

The taxpayers looking for ways to amend their tax returns for any reasons have to deal with 1040x Form. This document is important for the following:

- Correct forms 1040, 1040A, 1040EZ,1040NR, 1040NR EZ.

- Change amounts already adjusted by the Internal Revenue Service.

- Make a claim for a carryback because of a lost or unused credit.

The most common reason to fill IRS 1040-X blank is to correct mistakes in an original tax return document. To organize the process properly a person may use online templates. They are extremely convenient for quick and correct document preparation. Online samples enable you to sign them electronically, that completely eliminates paperwork hassles. After signing, you may share the file via email, fax or sms.

The 1040x Form is self-explanatory thanks to the detailed description of all necessary steps so that the taxpayer can record all details properly without any complication.

- The header of the first page here is similar to the 1040 Form. Indicate the tax year you want to amend. In case, you need to make changes for more than one year, create a separate document for each one.

- Pryour name and social security number, address and contact numbers.

- Read attentively the left-most column that contains detailed descriptions and instructions.

- All figures have to be provided in the right three columns.

You can file the 1040-X Form within three years from the date you submitted your original return.

Online solutions enable you to arrange your document administration and increase the productiveness within your workflow. Observe the quick guideline in order to entire Form 1040-X, stay clear of faults and furnish it inside of a timely way:

How to accomplish a Form 1040-X on the internet:

- On the web site together with the sort, click Get started Now and move to your editor.

- Use the clues to fill out the related fields.

- Include your personal information and make contact with knowledge.

- Make certainly you enter accurate material and figures in ideal fields.

- Carefully check the content material within the sort in addition as grammar and spelling.

- Refer to help you section should you have any queries or handle our Guidance crew.

- Put an electronic signature with your Form 1040-X with all the assist of Indicator Tool.

- Once the form is finished, push Done.

- Distribute the ready sort through email or fax, print it out or help you save on your own unit.

PDF editor allows for you to definitely make variations on your Form 1040-X from any world-wide-web connected equipment, personalize it in keeping with your needs, indicator it electronically and distribute in several methods.