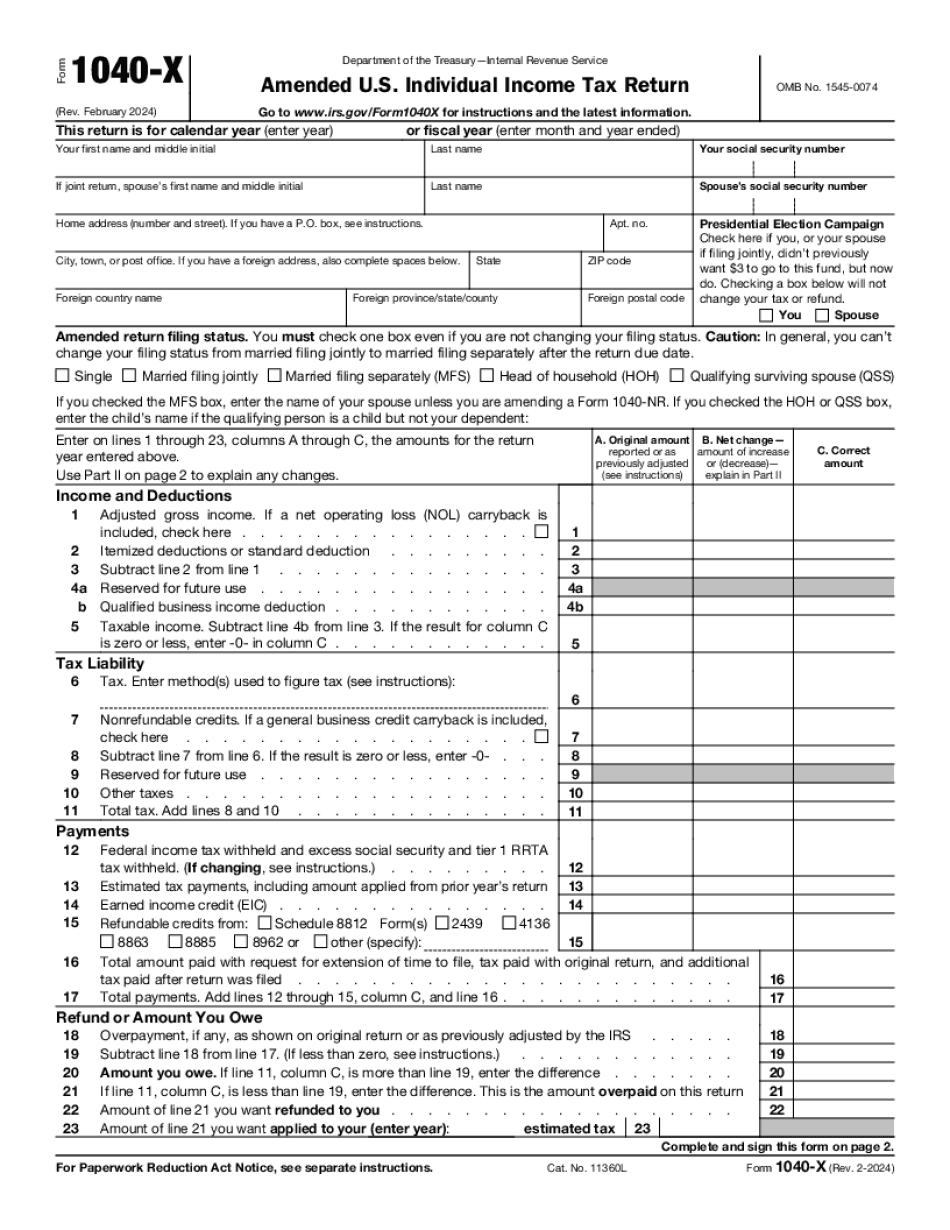

Should 1040-x be filed on changes that have no impact ?

It depends on the circumstances. If you have stock sales of $50,000, and no gain, the return would not change, but the IRS will be asking about the $50,000 of stock sales. If you overstated your withholding by $2, dont bother.