Award-winning PDF software

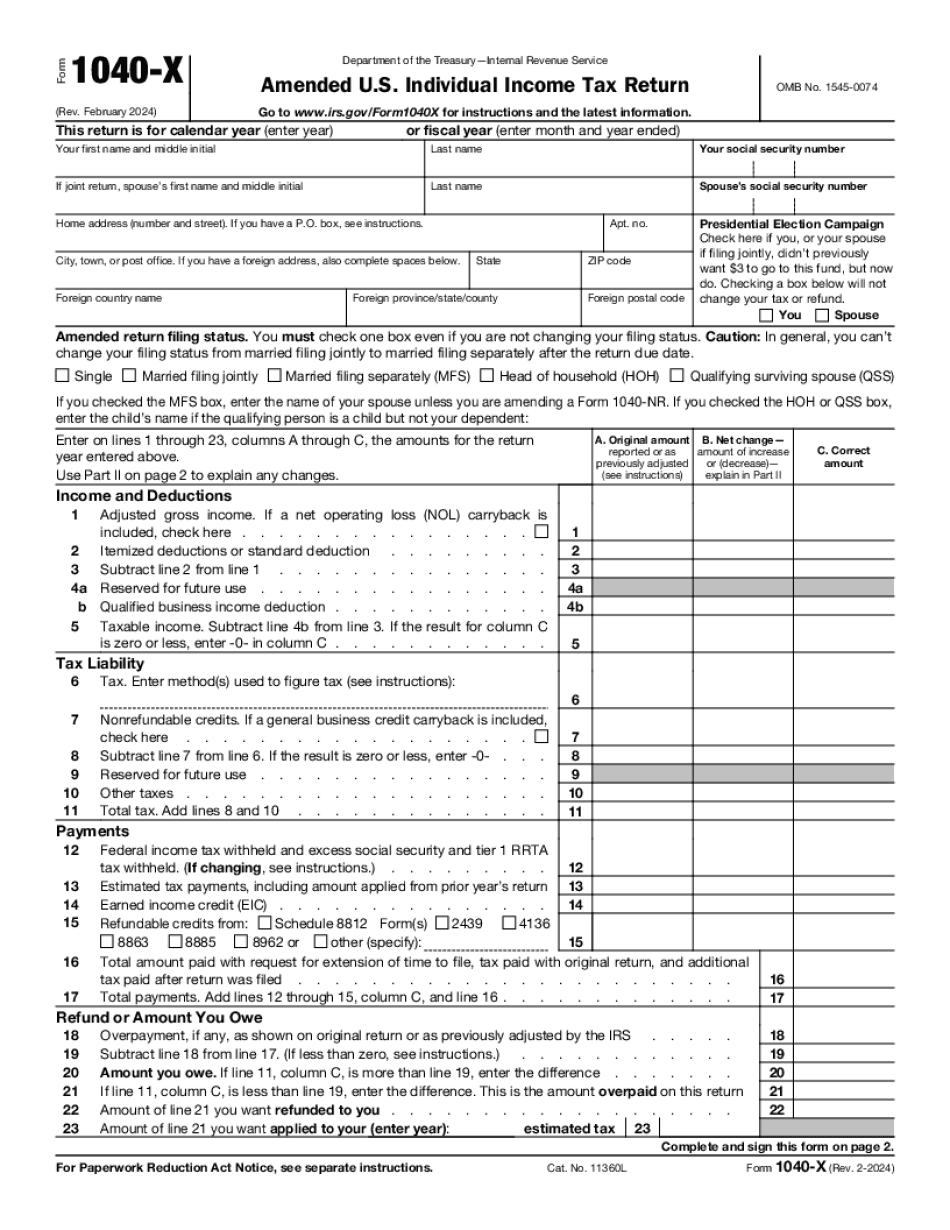

Form 1040-X for North Charleston South Carolina: What You Should Know

Section 25-24-30/15 (9): (f) The property may be sold and the proceeds shall be deposited into the municipal treasurer; except, that, the property may be sold at public sale or have the proceeds deposited into the treasurer for sale at public auction, and the proceeds shall be placed in a special fund for the purposes stated in Article 25 of the South Carolina constitution, subject to the approval and supervision of the council. [emphasis added] Tax exemptions in South Carolina and state are generally based upon a resident's gross income excluding interest or dividends and income taxed in other states. Taxpayers living in South Carolina can qualify for a federal non-deductible home mortgage interest deduction of up to 750,000 per taxpayer and can claim a state income tax exemption from the sale or transfer of real property, but South Carolina does not have a state tax deduction for state and local income taxes. South Carolina does, however, offer tax deductions for federal taxes that exceed 10 percent of adjusted gross income, based on the federal alternative minimum tax (AMT). South Carolina does not have a mortgage interest deduction on the federal level and only 250 may be taken as deduction from the income tax per year on federal mortgage interest payments with the IRS currently charging an effective tax rate of 3.9 percentage points. In addition, South Carolina does not have a mortgage interest deduction on the state level. SC Code 12-43-220(c): For tax years and other purposes defined in Article 25 of the South Carolina constitution, except as otherwise provided in the application of this chapter, “Municipal Treasurer” includes the director of the Tax Collector's office. “Municipal Treasurer” includes an administrator, deputy administrator or assistant administrator, or an officer or employee of the Tax Collector. In this instance, a Charleston County homeowner may be exempt from the county property tax on the basis of a home built under the “Home Improvement Contract Code” which is a federal exemption and is available to all homeowners, including those living and using the property as a residence.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040-X for North Charleston South Carolina, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040-X for North Charleston South Carolina?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040-X for North Charleston South Carolina aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040-X for North Charleston South Carolina from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.