Award-winning PDF software

Form 1040-X online Davenport Iowa: What You Should Know

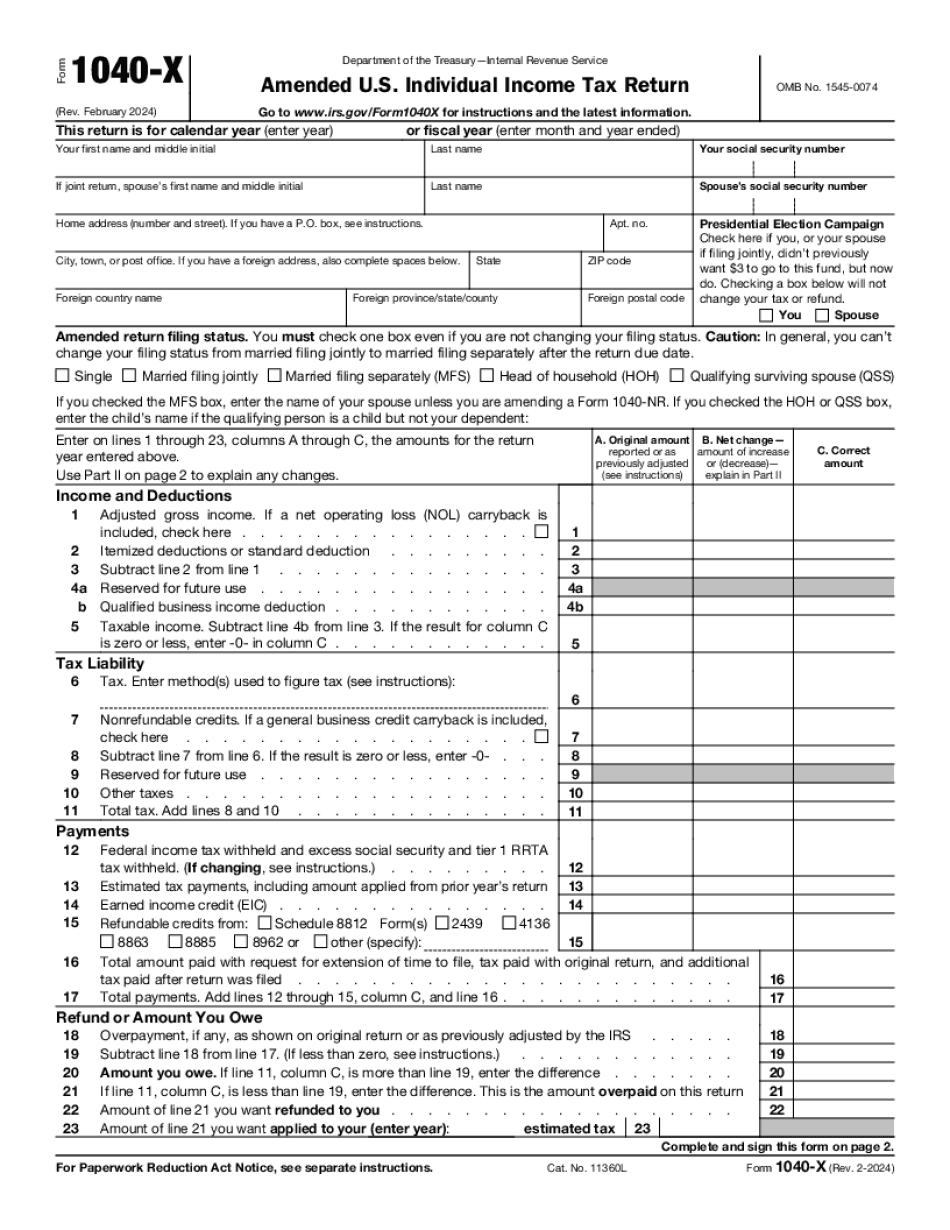

It's a way to correct an error or claim one of the tax breaks. Form 1040-X, Amended Income Tax Return of a Major Operation You can file Form 1040-X if you can show a loss that results from a major operation. It allows you to correct an error on your income tax return (Form 1040), pay tax you are owed, or claim a tax break. Here's how to file the amended return with the help of the IRS Form 1040-X. Form 941-X, Income Tax Return of a Major Operation You can use Form 941-X to report the income of a major operation. To make sure you're prepared for when your return is expected to be filed, review this guidance on preparing a Form 941-X for a major operation. What is a “Major Operation?” A “Major Operation” is a trade, business, profession, or occupation for which you must pay income tax. Major operations include: • a partnership, employer, or partnership • an independent contractor • a government entity • an investment business As a result of changing circumstances, a person could be considered a person who will be paying income tax in the future. The person may be exempt from or will be subject to paying income tax, or the person may file a Schedule SE. An example of a major operation is a business venture that results in a significant increase in your income. In the following example, we know that, since 2014, this student has owned and operated his own medical practice. That means he will pay income taxes in the future, so he has a legitimate Major Operation. In addition, the student owns his own business or professional practice (whether a limited or unlimited enterprise). The student may file a Schedule SE for income tax he is subject to paying as an independent contractor or a part-time employee. Notice 2015-20, Small Business and Self-Employed Tax Tips & Procedures, explains how to use the Form 1040 line 21 (Business Income) to determine when you will be filing as an independent contractor or a part-time employee. Review the following sections for other important information and procedures when preparing and filing Form 941-X. Tax Tip 2017-21, Tips on Using IRS Form 941-X and Other IRS Services for Estimating Tax for Business or Independent Professionals, describes why Form 941-X may be used more frequently than other sources.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 1040-X online Davenport Iowa, keep away from glitches and furnish it inside a timely method:

How to complete a Form 1040-X online Davenport Iowa?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 1040-X online Davenport Iowa aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 1040-X online Davenport Iowa from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.